Bill Morecraft

Senior Vice President

Projections for the 2018 California almond crop continue to shrink relative to the original NASS Objective Estimate of 2.45 billion lbs. The release of the November ABC Position report shows receipts of 1.986 billion lbs, falling below the level of last November by nearly 7 million lbs. November 2018 receipts of 433 million lbs were lower than last November by 31 million lbs. The slow down points to a potentially smaller crop expectation than last month. Barring unprecedented late receipts, the 2018 crop is likely to come in short of 2.3 billion lbs.

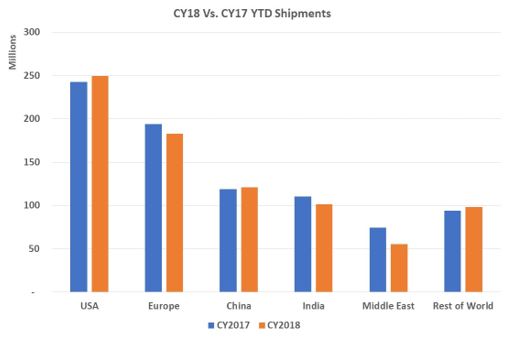

Overall shipments are within 3% of last year, with a strong December looming. U.S. shipments are up 3% for the year. The bigger shift was the strength in shipments to China, shipping 53 million lbs and surging to a net gain YTD. The Chinese market was projected to be no better than 80% of the prior year due to uncertainties surrounding trade issues. The strength is a significant factor in driving up recent demand for production and shipments. Shipments by region show the strength in the US and China. EU shipments are marginally softer, India was light in November and expected to rebound, and the Middle East began gaining momentum in November with an increase of 8% for the month.

New commitments of 240 million lbs in November are a record for the month. 2018 crop activity has surged since October, closing the gap on prior year activity that existed at the end of September.

With the projected supply shrinking, and shipments surging in October and November, prices have responded by climbing by $.15-$.35 per lb depending on the item.

|

Market Perspective Pollenizer pricing has seen a strong uptick and will remain firm and rising, as it is becoming increasingly likely that there will be late season shortages similar to last season. Nonpareil pricing has risen more moderately, but the recent boost in demand in China and the Middle East has brought Nonpareil supply & demand in tighter balance. December and January look like strong shipment months, providing firm pricing in the next 90 days. As the supply tightens up late in the year, pollenizer pricing may continue to close the gap on Nonpareil pricing. |

Click here to view the entire detailed Position Report from the Almond Board of California site: