Laura Gerhard

Vice President

OVERVIEW

The California almond industry posted shipments of 217.1 million lbs for the month of October compared to last year’s 309.6 million lbs. Shipments were widely expected to be lower than last October’s all-time record, however the 30% decline lands at the very low end of expectations. Exports for the month were down sharply to 84 million lbs or 36% lower vs last year. The domestic market showed a respectable 65.2 million lbs in shipments. While this was a departure from last year’s unprecedented record of 73 million lbs and a decline of 11.6% over last October, it was similar in pace to calendar 2019. Shipments across all regions for the first quarter now stand at 652 million lbs, a 14.6% decline or 112 million lbs off last year’s pace. Weakness in exports contributed 104 million lbs to the shortfall.

SHIPMENTS

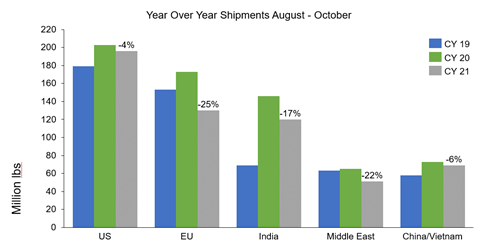

Declines in export markets were widespread with ongoing shipping and logistical issues. Europe was down 50% for the month, and 25% lower for the quarter. The European market pulled old crop strongly last spring and summer filling warehouses at the end of the crop year to combat shipping delays in preparation for the holidays. This market continues to be well covered through the calendar year. China has been impacted significantly with vessel delays and early Chinese New Year demand, citing a 22% decline over last October. California sellers have been unable to guarantee shipment arrivals in the narrow window resulting in a missed opportunity to meet consumption demand for the holidays. Last year, California exported a combined 52 million lbs to China for November and December and it is believed due to the current shipping issues the industry will be hard pressed to get close to that number for this year. The Middle East has also experienced lower shipments due to strong inventories and was down 30% for the month. India on the other hand was somewhat relieved with the latest shipment numbers as it signals more ability to buy. Shipments were down 31% on the month and 17% YTD. Demand continues to be strong with solid Diwali sales. The market is hungry for additional product which should stabilize prices.

CROP COMMITMENTS

Commitments YTD at 747.9 million lbs which is 285 million lbs behind last October’s advanced levels, and a decrease of 28%. New sales for the month were 244 million lbs, which is only slightly behind last October’s number of 250 million, however 50 million less coming from the export markets. Sold and shipped as a percent of total supply is at 41.8% vs 51.4% last year. Uncommitted inventory is at 966 million lbs up 539 million lbs from a year ago. The industry remains behind on bookings given limited selling early on due to drought concerns. Many markets entered the crop year adequately covered with low priced carry-in volume and early booked new crop causing buyers to back away from early purchases at higher levels. The combination continues to weigh on pricing as the market searches for demand.

HARVEST

Crop receipts for October are trending at nearly the same pace as last year coming in at 1.794 billion lbs versus the prior year of 1.811 billion lbs. There are no new indicators of total crop size, although many expect the crop to come in above the 2.8-billion-pound NASS Objective Estimate. Strong receipts and large carry-in are putting pressure on prices as bin and storage space fills up.

|

Market Perspective Near term demand remains challenged with many markets entering the crop year with adequate coverage and full supply pipelines. Weaker shipments with ongoing global shipping challenges continue, however, there is a growing concern with export commitments not keeping pace. Prices continue to slide in search for demand to create a situation where California can draw down carry-in inventory to manageable levels going in to the 2022 season. Vessel logistics will continue to complicate execution with untimely arrivals due to rolled bookings and cancellations. In the current market environment, it would be prudent for buyers to purchase sooner rather than later to avoid further complications in their pipelines. While prices will continue to be challenged in the coming weeks, demand is expected to return at these lower price levels as several markets will look to restock depleting inventory positions. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here