Bill Morecraft

General Manager

Global Ingredients

Blue Diamond Almonds

Overview –

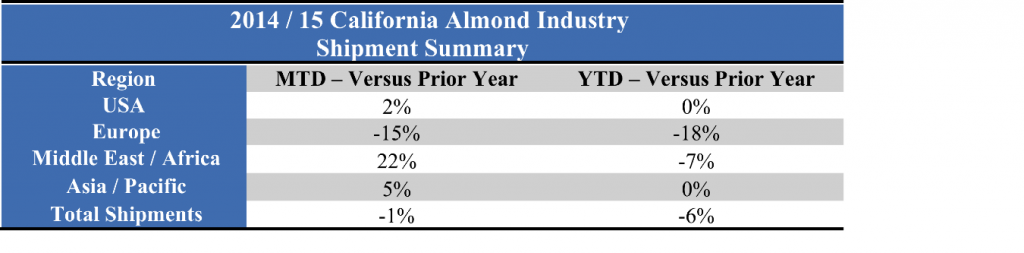

Execution of the 2014 California almond crop is winding to a close. Through eleven months, YTD shipments are 1.69 billion lbs, 6.3% below last year. Total commitments are at 261.7 million lbs, 10% higher than last year. Uncommitted inventory has dropped to 210.4 million lbs, 5.6% less than last year. Ending inventory through July should finish between 330 and 340 million lbs, after the Almond Board of California (ABC) adjusts the final inventory figures.

The 1.8 billion lb Objective Estimate leaves the 2015 supply down 3-4% from this year. As harvest kicks into high gear in the latter part of August we will gain insight to the impact of the ongoing drought on the new crop.

Market responses to the Objective Estimate have been mixed. The nut count was concerning, recorded at 12% lower than in 2014. Some buyers have elected to cover quickly, while others are hesitant. Many suppliers prefer to wait until harvest has begun before moving forward with sales. Pricing has firmed, with 2014 and 2015 crop selling at parity. Limited supplies are available until the new crop arrives. Long term weather forecasters are pointing to increasing signs of an El Nino through the Fall and early Winter.

|

Market Perspective – With a smaller 2015 almond supply, short term pricing will remain firm. With demand remaining tight vs. supply, the trend will continue unless the crop is larger than 1.8 billion. Based on the nut counts and kernel weights, it appears more likely that there could be a downside to supply this year. As a result of the tight supply, the ongoing demand watch will continue through another year. Global almond consumption has been very inelastic, with little decline despite the highest prices in history. Continued firm prices today and the prospects of a strong El Nino will likely create a repeat of last year’s pattern of lighter, long term commitments and more relatively prompt shipping purchases and sales. Early harvest results will be the next significant market mover, with all parties watching closely to determine if the Objective Estimate proves closer to actual results this year.

|

Click here to view the entire detailed Position Report from the Almond Board of California site: