Laura Gerhard

Vice President

OVERVIEW

March shipments totaled 221.4 million pounds, meeting market expectations. Export shipments were slightly lower at 169.6 million pounds, a 3% decrease year-over-year, while domestic shipments saw a significant 17% decline. Year-to-date shipments stand at 1.8 billion pounds, 1.6% behind last year’s pace.

SHIPMENTS

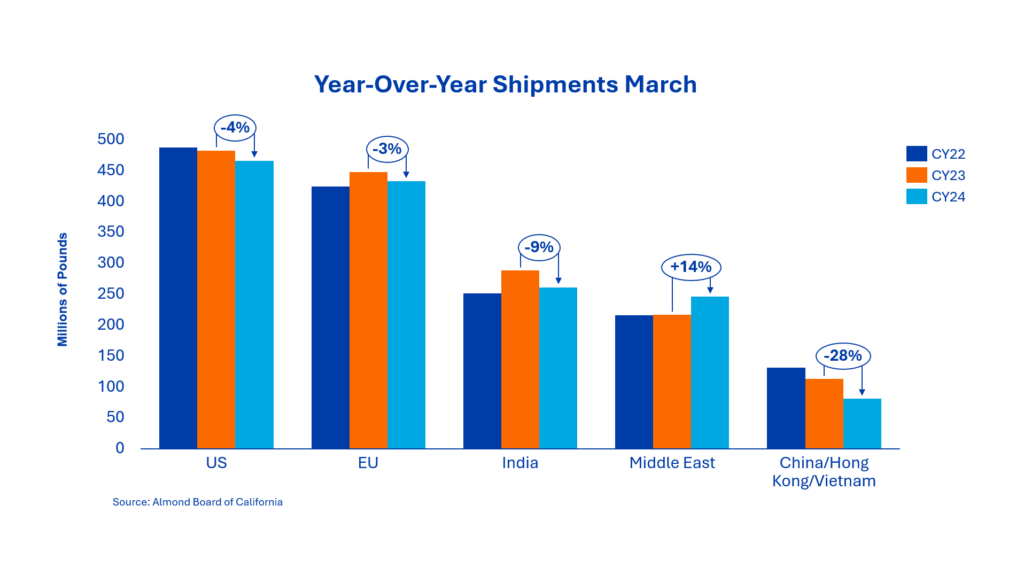

India: March shipments totaled 39.7 million pounds, marking a 55% increase from the previous month and a 68% rise from last year. The year-to-date gap continues to narrow to 9%, with total shipments at 261.1 million pounds, compared to 288.2 million pounds at the same time last year. The 1,200-plus containers shipped in March represent a strong rebound compared to the 800 containers shipped in February. With an early Diwali approaching, shipments are expected to remain strong for the remainder of the crop year. As tariff advantages continue to benefit Australian shipments into China, California almonds will be the primary supplier to the region.

China/Hong Kong/Vietnam: Shipments to the region totaled 7.0 million pounds in March, reflecting a 23% decrease compared to last year. Year-to-date shipments are down 28%, with tariffs continuing to impact new sales in the region. Chinese buyers continue to source almonds from Australia due to tariff challenges, which has limited the competitiveness of California almonds. However, Hong Kong traders have increased business into Southeast Asia, leading to a 37% rise in year-over-year shipments to Vietnam through March. With the ongoing geopolitical changes, buyers will need to explore alternative ways of doing business to ensure a steady supply for the remainder of the crop year.

Europe: Europe’s shipments totaled 52.2 million pounds in March, down 19% compared to the same period last year, bringing year-to-date shipments to a 3% decrease. Despite this, demand remains strong, with many buyers uncovered for the upcoming months. With standards prices surging above $3/lb and processor-grade almonds in short supply, current pricing is expected to remain supported. Tariffs continue to dominate discussions, with many buyers considering purchasing additional tonnage before the tariff implementation date, now moved to December 1st.

Middle East: Shipments totaled 23.8 million pounds in March, down 23% compared to last year. However, year-to-date shipments still show robust growth at +14%, with Saudi Arabia, Turkey, and Jordan leading the way. Market feedback for Ramadan consumption has been positive, and post-Ramadan restocking has already begun, with market activity picking up in the last week. Lower destination pricing from recent months is beginning to align more closely with origin prices.

Domestic: March shipments totaled 51.79 million pounds, reflecting a 17.1% decrease compared to last year. Domestic shipments now total 465.5 million pounds, marking five consecutive months of decline, with year-to-date shipments down 3.5% from the prior year. New sales continue to lag behind last year’s pace, down 19.5%. While demand remains, buyers are reassessing their volume needs for the remainder of the crop year, particularly given the potential for demand softening. With rising prices, buyers are increasingly focused on ensuring they secure appropriate contracts to meet their future needs.

COMMITMENTS

Total commitments remain steady at 573.6 million pounds, essentially flat compared to last year. New sales for the month reached 217.6 million pounds, marking the second strongest March on record and a 20% increase over last year, driven by strong demand in export markets. Assuming a 2.7-billion-pound crop, current shipments and commitments now account for 76% of total supply, narrowing the gap over the last several months and bringing it in line with last year. The industry is on track to achieve a similar tight carryout to last year, near 500 million pounds.

CROP

As the 2024 crop wraps up at approximately 2.7 billion pounds, focus will shift to the 2025 crop. Crop development will be closely monitored throughout the spring and summer months. Various estimates will be released in the coming weeks, providing additional forecasts and perspectives, including the NASS Subjective Estimate on May 12.

|

Market Perspective March shipments slightly exceeded industry expectations, keeping the market in a balanced supply and demand situation. Demand remains steady, with strong purchasing in export markets, but both buyers and sellers continue to maintain short positions as pricing continues to rise. Many are navigating the uncertainty around potential tariff impacts. Demand is expected to pick up in the coming weeks as initial reports and forecasts are released, providing buyers with more clarity for their purchasing decisions. As California transitions to warmer and drier weather, the industry will continue to monitor the progress of the 2025 crop. The NASS Subjective Estimate, the industry’s first official estimate, will be released on May 12. For those attending INC Majorca during the week of May 5, we look forward to connecting with you! |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here