Laura Gerhard

Vice President

OVERVIEW

March shipments exceeded industry expectations, reaching 237 million pounds, a 7% increase from the previous month but a 16% decrease from last year’s record month. Export shipments rebounded by 7% to 175 million pounds compared to last month’s dip, while domestic shipments also improved 6% from the prior month. Total shipments maintained a positive growth trend of 2.3% compared to last season. Overall, shipments remained strong keeping the industry on pace for a 500-million-pound carryout.

SHIPMENTS

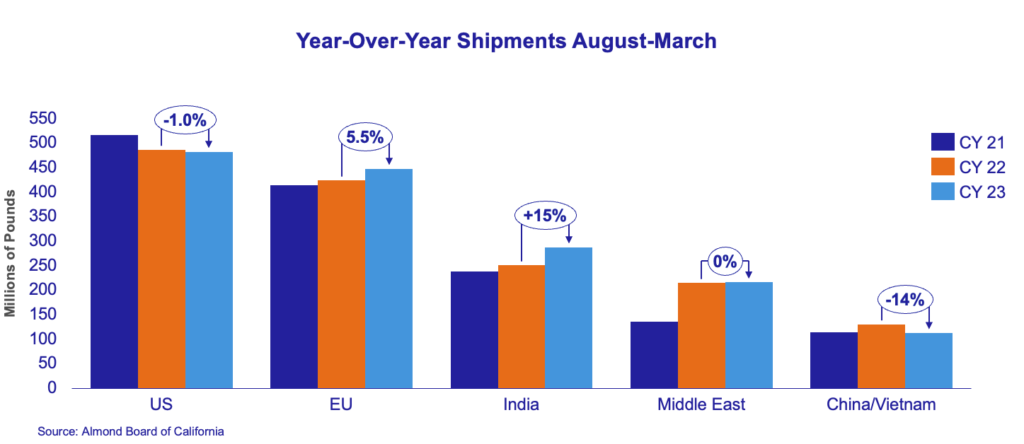

India: Shipments to India were 23.6 million pounds, down 14% to last year. Year-to-date shipments are 15% ahead of last season. Buying activity has increased in recent weeks after a relatively quiet March. Demand is expected to persist in the coming weeks given India has work to do to cover needs for late May and June shipments. Additionally, buyers will start to consider new crop purchases following early estimates being released over the next few weeks.

China/Hong Kong/Vietnam: Shipments to the region remained slow, totaling 9.1 million pounds, down 68% to last year and 14% year-to-date. Year-to-date shipments to China alone trail last season by 26%. Chinese consumer demand remains limited due to poor economic conditions. Buyers are turning to cheaper options from Australia and Southeast Asia to meet existing demand. Demand is expected to remain limited in the short term. New crop interest is expected to rise in the summer months as China begins to position itself for an earlier 2025 Chinese New Year holiday.

Europe: Shipments to the region were 64.6 million pounds. This is down 8.9% to last year but up 5.5% year-to-date compared to last season. With price softening in recent weeks buyers have taken a conservative approach, mainly making hand-to-mouth purchases. Demand is expected to increase in the coming weeks as buyers seek to cover third quarter and to a greater degree fourth quarter needs to maintain sufficient pipelines.

Middle East: Shipments to the Middle East totaled 31 million pounds, down 15% to last year, but Year-to-date shipments are now on par with last year. Reports of Ramadan consumption have been positive with buyers becoming more active as the holiday concludes. Some demand challenges persist due to current geopolitical tensions. Overall, attractive pricing is likely to drive short-term buying interest.

Domestic: March shipments reached 62.4 million pounds, down 6% from the prior year. Year-to-date shipments are approximately 1% behind last year’s pace, with continued mix results month over month. New domestic sales for the month totaled 50.3 million pounds, bringing commitments to 254 million pounds. Overall, domestic commitments remain behind by 12.4% from the prior year but improved from 19.4% in February. As the booking gap continues to narrow, there is ample demand yet to be covered. The buying strategy for the past few months has focused on covering short-term needs until there is more clarity on market pricing. With the tail end of the season in sight, and various industry updates on new crop coming over the next month, the market is anticipated to become much more active for the balance of this crop year and into quarter one of next crop year.

COMMITMENTS

Total commitments improved for the second consecutive month to 576 million pounds marking a 9% improvement over last month while remaining down 11% to last year. Additionally, uncommitted inventory is down 12% to last year, reaching 774 million pounds resulting from this year’s reduced supply. New Sales for the month were 182 million pounds, representing a 27% increase to last year. Total new sales for the year now exceed last season by 2%. Assuming a 2.45-billion-pound crop, shipments and commitments represent 77% of total supply versus 73% last year. The industry remains on pace to reach a carryout of nearly 500 million pounds, a level not seen in the past three years. This development is encouraging and is expected to provide some much-needed price stability going forward.

CROP

With the 2023 crop wrapping up and coming in around 2.45 million pounds, the focus will now shift to 2024 crop. Crop development will be closely monitored throughout the spring and summer months. Meanwhile, various estimates will be released in the coming weeks offering some additional forecast and perspective, inclusive of the NASS Subjective Estimate on May 10.

|

Market Perspective March shipments exceeded expectations, keeping the industry on track to reduce the carryout to a more manageable level around 500 million pounds. Following a positive almond bloom, buying interest has waned in recent weeks causing price to soften as a result. Buyers acknowledge the attractiveness of current price levels but remain conservative in their approach and are intent to wait and see how much further prices may decline. Current market prices reflect a better than average crop, although it is premature to make a definitive assessment. Demand is expected to gain momentum in the coming weeks upon release of the initial reports and forecasts that will offer buyers some semblance of guidance for their purchasing decisions in the near term. As California transitions to warmer and drier weather, the market will continue to monitor the progression of the 2024 crop. The NASS Subjective Estimate, the industry’s first official estimate, will be released on May 10. For those of you attending INC Vancouver during the week of May 6, we look forward to visiting with you! |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here