Laura Gerhard

Vice President

OVERVIEW

In July, the final month of the 2023 crop year, almond shipments totaled 179.4 million pounds, reflecting a 4% decrease from the previous year and falling short of industry expectations. Domestic shipments were 53.1 million pounds, down 6% from the prior year. However, total domestic shipments for the year reached 728 million pounds, representing a 1.6% increase for the season. Export shipments for July totaled 126.3 million pounds, down 3% year-over-year. Nevertheless, total annual export shipments reached 1.96 billion pounds, an increase of over 6%.

Overall, annual shipments totaled just under 2.7 billion pounds, up 5% from the previous year, making it the second-largest year on record and the first positive annual growth since 2020. The carryout for the year stands at 505 million pounds, a 36% decrease from prior year. With additional quality losses exceeding 2% this season, the carry-in for the 2024 crop is expected to fall below 500 million pounds. This more balanced supply and demand outlook should support price stability as we move into the next crop year.

SHIPMENTS

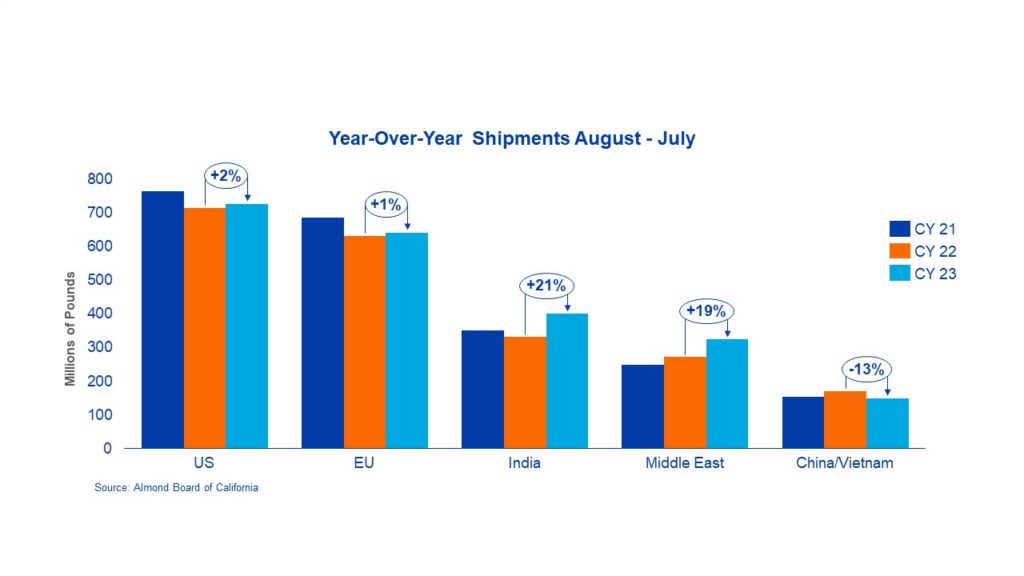

India:In July, shipments decreased by 19% from the previous year, totaling 19.6 million pounds. However, by the end of the year, total shipments had increased by 21% from the prior season, reaching a record high of 400.2 million pounds. This month saw limited activity as both sellers and buyers acted cautiously. Inshell prices fell relative to the subdued market, with buyers waiting for signs of stability. Some buyers capitalized on small-volume purchases to secure lower prices, though these did not reflect the overall market trend. Looking ahead, strong demand is expected to emerge to meet post-Diwali requirements.

China/Hong Kong/Vietnam: Shipments to the region totaled 8.8 million pounds for the month, a 19% increase from the previous year. However, by the end of the season, the total dropped by 13% to 148 million pounds. China faced challenges with low demand throughout the year, ending the season 26% lower than the prior year. Some of this demand shifted to Southeast Asia, which benefited from more favorable duty structures, with Vietnam and Thailand seeing increases of 56% and 29%, respectively, by year-end. Buyers are currently cautious but will soon need to make purchases in preparation for the earlier Chinese New Year festival. The upcoming Mid-Autumn Festival in September will provide valuable insights into future demand trends and set the tone for the market going forward.

Europe: Shipments to the region totaled 48.3 million pounds, marking an 8% decrease from last year. Despite this, the region ended the crop year up over 1%, totaling 642 million pounds. With pipelines running low, buyers will need to purchase additional coverage to complete shipments for the remainder of the calendar year.

Middle East: Shipments to this region continued their strong performance, totaling 18.2 million pounds for the month, marking a 44% increase from last year. The Middle East concluded the crop year at 324.4 million pounds, a 19% rise over the previous year. Recent market activity has been subdued, with buyers anticipating a potential softening in prices. Demand is expected to increase in the coming weeks to meet the needs for the earlier Ramadan holiday.

Domestic: In July, shipments exceeded 53 million pounds, reflecting a 6% decrease from 2023. Monthly shipments this year have fluctuated significantly, resembling a rollercoaster ride. However, a strong second half led to year-over-year growth after two consecutive years of decline in the domestic market. For the 2023 crop year, shipments totaled over 728 million pounds, marking an increase of 12 million pounds or 2%, from the previous year. Looking ahead, the domestic market remains pivotal for the industry’s overall performance. Economic headwinds affecting point-of-purchase decisions and shelf prices will need to be countered with innovation to boost almond demand. New crop commitments have risen by nearly 30 million pounds compared to the previous year, indicating adequate coverage to meet near-term demand for the new year.

COMMITMENTS

Total commitments for the year amount to 238 million pounds, reflecting a 36% decrease from last year and highlighting the low levels of uncommitted inventories not seen in recent years. At the end of July, uncommitted inventories stood at 268 million pounds, also down 36% from the previous year. New sales for the current crop totaled 70 million pounds, a 36% decline compared to the prior year, largely due to a market slowdown and unexpected price increases from the Objective Estimate. Despite this, year-to-date sales are 3% higher than last season. Buyers have turned to more affordable prices in their local markets, utilizing limited available inventories. California prices are expected to stabilize once demand returns.

New crop sales increased by 32% over the previous year, reaching 98 million pounds. As the industry moves into the 2024 crop year, booked sales are 85% higher than the previous year.

CROP

With an anticipated carry-in of less than 500 million pounds and an estimated crop of 2.8 billion pounds, the total supply for the 2024 season is essentially unchanged. Harvesting commenced two weeks ago; therefore, it is too premature to predict the production volume or quality. Additional details will be provided in the upcoming weeks.

|

Market Perspective The industry concludes the 2023 crop year on a positive note, with total shipments rising by 5%. The carryout has been successfully reduced to reflect a more balanced supply and demand outlook. Market activity for the month was subdued, as prices firmed following the Objective Estimate. While buyers are preparing for holiday season requirements, they have adopted a “wait and see” approach to monitor price trends. Prices are expected to stabilize as demand picks up in the coming weeks. Harvest is underway, and the outlook for the 2024 crop will become clearer as we evaluate receipts for quality, size, and supply potential in the weeks ahead. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here