Laura Gerhard

Vice President

OVERVIEW

July shipments totaled 197 million pounds, surpassing industry expectations and marking the second-highest shipment volume ever for the month, up 9.87% year-over-year. Exports drove the increase, reaching 147 million pounds, a 16% rise compared to last July, while domestic shipments showed a modest decline. Total shipments for the crop year now stand at 2.64 billion pounds, down 1.7% versus last year.

SHIPMENTS

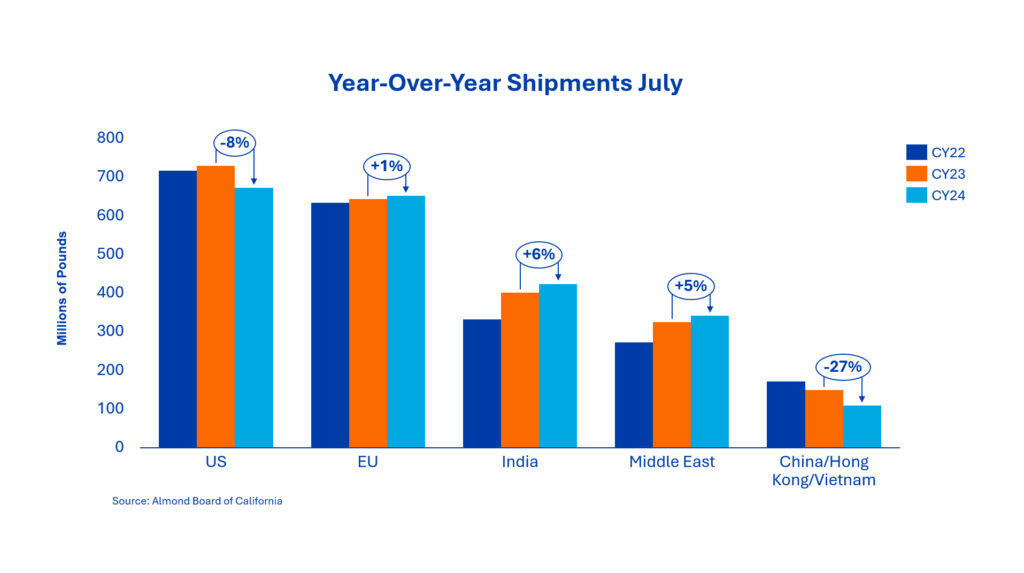

India: July shipments surged to 45.9 million pounds, up 134%, setting a monthly record and marking the second-highest shipment month of the year. Exports for the crop year now total 423.1 million pounds up 5.7% vs. last year, establishing a new record for annual supply. India led global demand, with importers pulling forward volumes ahead of an early Diwali. The market is shifting from price discovery to execution, with arrival timing, kernel sizing, and quality driving near-term buying decisions. While some Diwali demand remains open, heavy July inflows indicate that incremental needs will likely be met locally. Overall sentiment remains cautious, with forward coverage closely tied to harvest performance and early quality assessments.

China/Hong Kong/Vietnam: Combined shipments to the region totaled just over 3 million pounds in July finishing the season down 27% year-to-date. The softness was largely expected, reflecting the ongoing impact of tariffs restricting direct flows into China. Vietnam, by contrast, posted a 36% annual increase, reinforcing its role as a value-added processing and transshipment hub for California almonds.

Europe: After a slow start to the 2024 crop year, Europe closed the season up 1.3% year-over-year. July shipments reached 55.5 million pounds, a 15% increase versus prior year. With tariff clarity now established, forward procurement is expected to take a more deliberate, phased approach, as buyers align coverage with Q4 consumption trends.

Middle East: The region closed the season up 5% at 340.7 million pounds, led by Saudi Arabia, Turkey, and Jordan as primary growth markets. July shipments slipped 21% year-over-year, reflecting elevated destination inventories and ongoing origin-to-destination price differentials. Spot market activity has remained muted amid seasonal consumption softness and ongoing political volatility. Forward interest is beginning to build for the 2025 crop, as buyers position early ahead of Ramadan 2026, aiming to secure arrivals well in advance of the holiday demand window.

Domestic: July shipments totaled 50.15 million pounds, down 5.6% from the same period last year, bringing year-to-date shipments to 671 million pounds, a 7.8% decline versus last year. The past year has been challenging for domestic demand, primarily due to sustained economic headwinds. This, coupled with USDA not repeating its prior-year purchase of 20 million pounds, resulted in final shipments reaching their lowest level since crop year 2015/16. Market activity picked up following the Objective Estimate and June Position Report, as buyers gained confidence in covering Q1 needs. Despite this uptick, significant demand remains to be covered for the remainder of calendar year 2025.

COMMITMENTS

New sales activity for the month demonstrated strong momentum, with 2024 crop commitments totaling 100.3 million pounds, up 43.4% year-over-year. New crop sales also gained traction, reaching 173.4 million pounds, a 60.9% increase versus last year. Despite this notable growth, total commitments for the 2025 crop remain behind last year’s pace.

CROP

Harvest has just commenced, and it is too early to forecast production volume or quality. As the season unfolds, industry attention will remain on receipts and realized yields to determine whether actual production aligns or diverges from the Objective Estimate.

|

Market Perspective The industry wraps up the 2024 crop year on a positive note, with total shipments down just -1.7%. Carryout remains largely unchanged from last year, reflecting a balanced supply-demand landscape. Market activity picked up as prices initially dipped sharply following the Objective Estimate, then stabilized and recovered as buyers moved to take advantage of lower levels and limited coverage. Prices are expected to remain strong as buying continues in the weeks ahead. Harvest is underway, and clarity on the 2025 crop will emerge as receipts are assessed for quality, size, and overall supply potential. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here