Laura Gerhard

Vice President

OVERVIEW

November shipments continued to build momentum marking the second highest November on record, reaching 238 million pounds, 16.6% higher than last year. The driving force behind this performance is the sustained high demand in the export markets, which accounted for 177 million pounds for the month, reflecting a 25% growth compared to last year. Domestic shipments continue to struggle coming in at 60 million pounds for the month, down 2% to last year. Despite the dip in domestic shipments, the overall year-to-date shipment figures present a positive outlook, with shipments posting a healthy lead of 9.6% over the same period last year.

SHIPMENTS

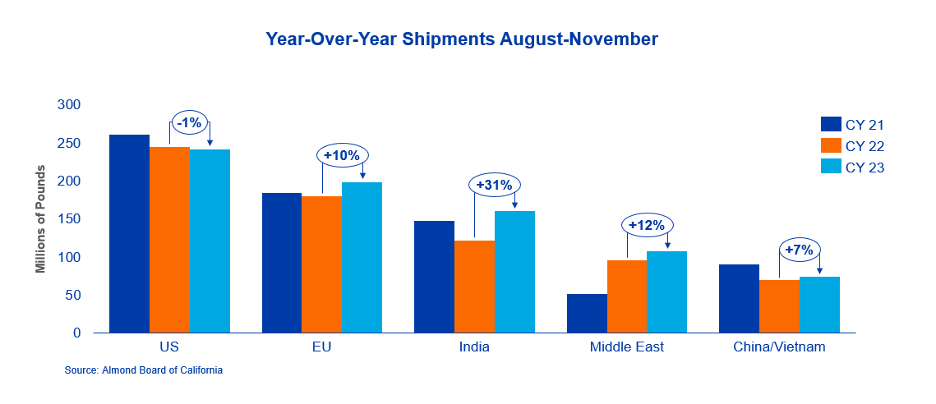

India: Shipments for the month totaled 38 million pounds, marking a 14% increase to last year. This performance contributes to a year-to-date growth of 31% in shipments to the region. India continues to be a prominent destination for inshell and with the ability to be flexible on quality parameters, this market has become very attractive given the quality of this year’s crop. Demand was active for the month of November but has quieted in recent weeks as vessels arrive to replenish local stocks. India will focus on working through the existing inventory which has pressured local price for the moment. Consumption remains robust with activity expected to pick back up in early January.

China/Hong Kong/Vietnam: Shipments for the month were 23 million pounds, up 122% to last year with year-to-date shipments now up 7% compared to last year. Notably, Vietnam is up 114% year-to-date and is driving the growth to this region. In contrast, shipments to China continue to lag and are now down 3% for the season. Buying activity remains conservative as macroeconomic headwinds persist. Importers continue to leverage Vietnam as a duty friendly option to satisfy consumer demand. Demand will continue to be monitored through the Chinese New Year holiday to determine needs for inventory to replenishment.

Europe: November shipments were up 17% to last year and up 13% to last month. Year-to-date shipments increased their pace and are now up 10.5% versus last season. Strong shipments were expected as this region positions itself for the upcoming holiday season. Buyers remained active in recent weeks covering needs for nonpareil and pollinizer kernels, setting the stage for another strong month of shipments in December.

Middle East: November shipments to the Middle East were up 22% to last year and are now up 12% for the season. The Middle East continues to be a strong and reliable market for the California almond industry with affordable prices continuing to fuel demand. The shipment window for Ramadan is now closed but demand is expected to persist as the region continues to buy for consumption following the holiday.

Domestic: November shipments, coming in at 60 million pounds, were lighter compared to last year, down 1.3 million pounds or approximately 2%. After the first four months of the season, domestic sales of 241 million pounds are now trailing last year by just over 1%. Commitments have continued to gain strength each month and November was no exception lagging last year by 13% versus 23% just two months ago. Domestic demand after the Holiday season will play a key role in customer inventory levels, commitments and shipments heading into the second half of the crop year.

COMMITMENTS

Total commitments stand at 647 million pounds, a 6.3% decrease compared to last year. New sales for the month reached 208 million pounds, marking a 4% increase over the previous year and the fourth consecutive month of higher year-over-year sales. Assuming a 2.40 billion pound crop, shipments and commitments currently represent 50% of the total supply versus 45% last year. While a very healthy first four months of the crop year, on-going sales are crucial to maintaining a strong shipment trajectory and reduce carryout to more reasonable levels.

CROP

Crop receipts for the year total 1.867 billion pounds. After the first four months the 2023 crop trails last season by 13% which lends itself to the late and challenging harvest. Many in the industry are now forecasting the crop to be around 2.40 billion pounds. Nonpareil receipts trail last year by 9%, the Independence variety is up 3%, Monterey is down 16% and Butte/Padre is down 33% compared to levels a year ago. The year-to-date total supply for the crop is 2.63 billion pounds, down 10.7%.

Land IQ’s final estimate for the 2023 almond crop acreage is 1,563,336 acres, comprising 1,374,331 bearing acres and 189,005 non-bearing acres. This represents a 2.3% increase in bearing acres compared to last year, while total acres are down by 4.5%.

|

Market Perspective The November position report fell within industry expectations, maintaining a strong start to the 2023 crop year. Export shipments outpaced the previous season while domestic shipments remained slightly off pace. Harvest is complete but the industry remains over two weeks behind last year as it works to process the remainder of the crop. Prices continue to firm as California handlers increase their sold position against supplies. Buyers are pivoting to larger kernel sizes and alternative specs as they come to terms with the reality that middle and smaller size kernels are in short supply this crop year. Overall, demand remains active, setting the stage for continued strong shipments for the coming months. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here