OVERVIEW

The November position report reflected industry shipments of 220.5 million pounds. This report reinforces what the industry has been signaling for several months: the 2025 crop continues to track meaningfully below the early season estimates, and total supply is now firmly positioned beneath last year. While shipments for November landed below prior year, export activity continues to drive overall movement, and the industry remains well-placed to meet global demand as we head into the second half of the crop year. With uncommitted inventory slightly below last year and receipts trending lower, the supply landscape supports a stable underlying market tone.

SHIPMENTS

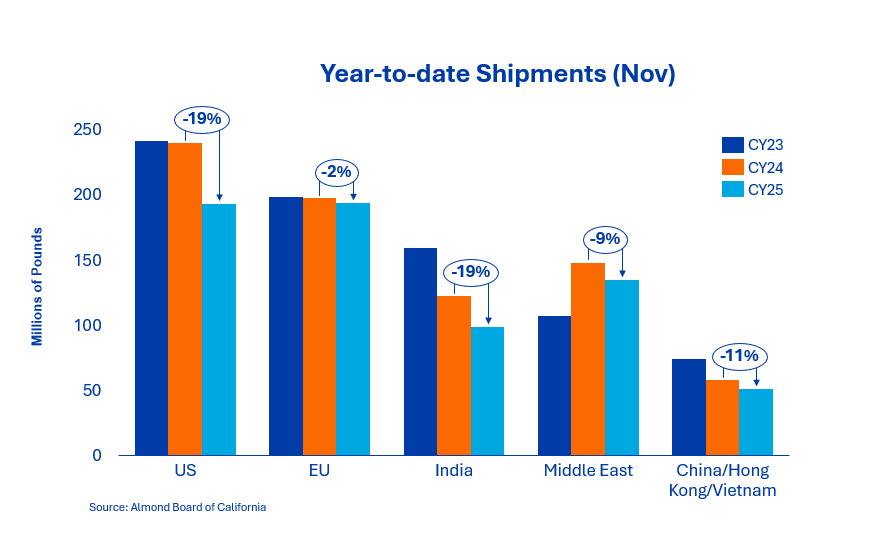

India: Year-to-date shipments to India stand at just over 99 million pounds, approximately 19% below last year. The slower pace reflects deliberate buying patterns and timing of forward coverage rather than a structural decline in underlying demand. India remains under-covered for early 2026, and the market’s forward needs continue to support a constructive, steady demand outlook.

China/Hong Kong/Vietnam: Market activity across the region continues to diverge. China/Hong Kong shipments are down 75% year to date, consistent with ongoing macroeconomic and trade-related constraints. Vietnam is a clear outperformer, up 82% year to date, driven by strong ingredient demand and opportunistic purchasing ahead of Lunar New Year. Combined, the region is down 13% for November and 11% year to date. Southeast Asia’s strength continues to offset weakness in greater China and remains one of the most dynamic demand centers for the industry this season.

Europe: European shipments remain essentially flat year over year, down just 2% for the season. Buyers continue to operate selectively, covering nearby needs as required. Notable overperformers include Spain and Italy, which have increased activity relative to last year. Core markets such as Germany and the UK remain steady, reflecting broader macroeconomic caution but stable almond usage.

Middle East: The Middle East continues to be a reliable, high-value demand region. Overall shipments are 9% below last year. Key importers, including the UAE, Turkey, and Saudi Arabia are only lightly covered and are prioritizing premium specifications and larger sizes, reinforcing firm pricing structures in those segments. While volumes are modestly softer year over year, demand for quality and consistency remain strong.

Domestic: November shipments reached 47.3 million pounds, down 13% from the same period last year. The domestic market continues to experience softer demand resulting from food category and economic headwinds, driving the market down 19.3% for the crop year. Corresponding commitments increased by 3.5% from last month with a decline from last year of 4%. Buyers are assessing Q1 and Q2 coverage while deciding when to step into the market. Hand-to-mouth purchasing and cautious selling have led to a market with ample volume to cover in future time periods.

COMMITMENTS

Total commitments currently stand at 545.2 million pounds, a 10.8% decrease from last year. New sales for the month totaled 204.3 million pounds with the domestic market layering in an additional 57.3 million pounds, while export added an additional 147 million pounds of new coverage. In total, commitments for the domestic market now stand at 208.8 million pounds, and exports stand at 336.4 million pounds. Uncommitted inventory is down 1.3% from last year, sitting at 1.25 billion pounds versus 1.27 billion pounds.

CROP

Receipts through November reached 2.2 billion pounds, reflecting a 6.6% decline compared to the previous crop year, largely driven by a slower receipt pace and lower turnout percentages. Overall crop size will become clearer after observing pollenizer receipts through December and continues to track meaningfully below the early season estimates. In November, growers fully transitioned out of in-orchard harvest activities and into post-harvest (fertilizer, cover crop plantings, pruning, sanitation, etc.) activities. Most huller-shellers are anticipated to finish by the end of December, with a handful running into early January. LandIQ published their 2025 Standing Acreage Final Estimate which revealed that total acreage continues to decline (fourth consecutive year since 2021), with non-bearing acreage falling to a 16-year low. Bearing acres are estimated to reach a historical high at approximately 1.4 million but does not consider abandoned (unharvested) acres attributed to challenged grower economics and water availability.

|

Market Perspective The market continues to operate within a framework of tightening supply and steady global demand. Export markets remain active, and buyers are approaching coverage decisions with increased discipline as they evaluate the smaller supply base. Quality and sizing remain key differentiators, and premium segments continue to command firmer values. As the industry progresses into early 2026, disciplined pricing strategies and measured selling will be essential in maintaining market stability and supporting long-term value for all stakeholders. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here