Laura Gerhard

Vice President

OVERVIEW

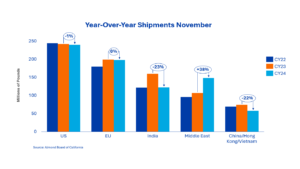

November shipments exceeded market expectations, reaching a record 271 million pounds, marking a 14% increase from last year and a 5% rise from last month. Export shipments led the way, totaling 217 million pounds and surpassing 200 million pounds for the first time, reflecting a 22% increase over last year. Domestic shipments showed month-to-month variability, posting a 10% decline for the month. As expected, shipments are recovering from the light volumes seen in the first two months, bringing year-to-date performance in line with last year’s figures.

SHIPMENTS

India: November shipments totaled 20.2 million pounds; a 47% decrease compared to last year. The year-to-date gap at the fourth month of the crop year has grown to 23%, with total shipments at 122.4 million pounds, compared to 159.8 million pounds at this time last year. Local sales have been strong across all channels, depleting inventories. The light shipment month serves as a clear indicator that India needs to purchase. Buying activity is beginning to pick up as buyers work to replenish their inventories.

China/Hong Kong/Vietnam: Shipments to the region for the month totaled 16.7 million pounds, reflecting a 28% decrease compared to last year. Year-to-date shipments trail last year by 22%. Shipments to China are down 42% for the year, as the country has been relying heavily on direct shipments from Australia due to their Free Trade Agreement (FTA), while supplementing with California product sourced through other countries not impacted by tariffs. As a result, shipments to Vietnam have increased by 63% year-to-date. Buyers in the region remain cautious about forward bookings as the Trump administration transitions, awaiting clarity on the future of the tariff agenda.

Europe: Shipments to the continent saw a significant rebound, posting its largest month ever at 85.9 million pounds, up 75% compared to last year. This brings year-to-date shipments in line with last year’s totals. The strong performance is not surprising, given the light shipments at the start of the year, with tight carry-in limiting the supply of European grade material. Demand remains strong, with additional coverage needed, although buyers are likely to continue taking a hand-to-mouth approach due to the high prices.

Middle East: The Middle East continues to be a region of strength for export volumes. Shipments for the month exceeded 42.4 million pounds, a 31% increase over last year; total shipments for the year are just shy of 148 million pounds, which is reflective of a 38% increase. Pricing has remained stable as most market participants have adjusted to the ‘new normal’ and confidence levels that price will remain supported continue to rise. With Ramadan needs covered, and many of the early bookings now arriving at destination, buyers will continue to monitor price action. They will now be looking to the new year for post-Ramadan replenishment to cover the Eid holidays, while Saudi buyers will also be looking to cover their demand for the upcoming Hajj pilgrimage, where over 2 million people are expected to congregate in Mecca for the event.

Domestic: November shipments reached 54.4 million pounds, 9.8% behind last year. Domestic shipments now stand at 239.9 MM lbs., down 1% from the prior year. We continue to see similar trends to last crop year with Domestic shipment results riding a wave but keeping a close pace to the prior year. Hand-to-mouth buying continues to be demonstrated resulting in domestic commitments being down 19.2% year-over-year. There is ample volume in the pipeline to cover upcoming shipment needs with potential for a strong close to the calendar year.

COMMITMENTS

Total commitments came in slightly below last year’s level at 611.8 million pounds, down 5.5% to last year. However, export commitments are up 4.2% totaling 394.1 million pounds. Uncommitted inventories now total 1.27 million pounds, up 19% from last year due to an earlier harvest. New sales reached 209.5 million pounds, a 1% increase over last year. Assuming a 2.8-billion-pound crop, current shipments and commitments account for 47% of total supply, compared to 49% last year.

CROP

This year’s harvest is essentially complete, with crop receipts totaling 2.34 billion pounds, this is up by 25% vs last year’s 1.87 billion pounds, but it’s worth noting that last year’s harvest period was delayed given weather conditions. Many in the industry are centering around the crop to likely come in lower than the 2.8 billion pounds.

|

Market Perspective The November position report significantly exceeded expectations, setting a new record for the month and bringing the year-to-date total for the first four months in line with last year. Sellers are gaining confidence as the crop is delivered and prices continue to rise. Likewise, buyers are adapting to higher prices and are becoming more confident in their purchases, no longer fearing an immediate price drop. With tight destination inventories, incoming products are going directly to market rather than being stored, signaling strong demand that should continue to support prices into the new year. The industry is closely monitoring receipts to assess the final crop size. Speculation is growing that the 2024 crop may fall short of the expected 2.8 billion pounds. While it’s still too early for a definitive conclusion, a clearer picture should emerge by January. The industry is closely watching potential tariff impacts from the Trump administration and how these could affect future demand. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here