Laura Gerhard

Vice President

OVERVIEW

January shipments exceeded market expectations, reaching 229 million pounds, marking the third-highest month on record and only a 3% decrease compared to last year’s peak. Export shipments were slightly lower at 167 million pounds, reflecting a 3% decline year-over-year. Domestic shipments saw a 2% decrease for the month. Despite these slight declines, the strong performance in January has kept year-to-date shipments essentially flat compared to last year, maintaining a steady pace.

SHIPMENTS

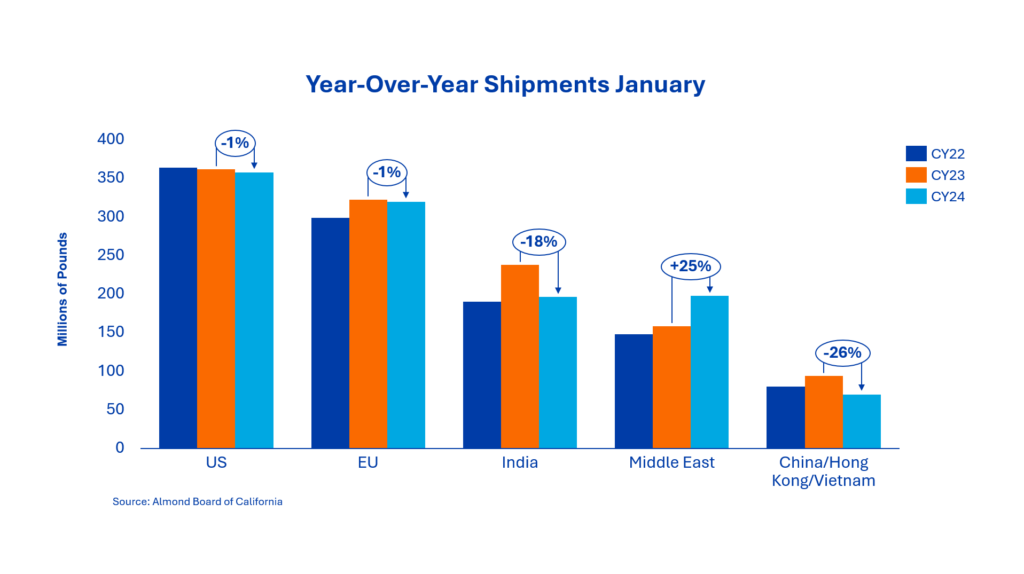

India: January shipments reached 38.8 million pounds, reflecting a 12% increase versus last month and nearly matching last January’s performance at -1%. The year-to-date deficit has narrowed to 18%, with total shipments at 195.6 million pounds, compared to 237.5 million pounds at the same time last year. Strong local sales, fueled by the wedding season, have depleted inventories. As buyers begin to recognize tight local inventories, robust purchasing activity in California is expected in the coming months.

China/Hong Kong/Vietnam: Shipments to the region for the month totaled 4.9 million pounds, reflecting a 24% decrease compared to last year. Year-to-date shipments are trailing by 25%, maintaining a steady pace month-over-month. Chinese buyers continue to explore alternative supply sources to bypass U.S. tariffs, leading to a 34% increase in shipments to the Southeast Asia region. While regional buyers have shown interest, limited business is being transacted at current California prices. With the new crop of almonds being harvested in Australia, demand for California almonds is expected to remain subdued.

Europe: European shipments for the period totaled 57.4 million pounds, reflecting a 6% decrease compared to the same period last year. Year-to-date shipment totals remained steady, showing a year-over-year difference of -1% for the continent. Prices have remained relatively stable, with buyers continuing to adopt a hand-to-mouth approach to securing their supply. After a slow start to the year, European buyers have rebounded strongly over the last three months, with shipments surpassing 50 million pounds each month. Demand from Europe is expected to continue on a steady, possibly slightly upward trajectory for the remainder of the year, as key buying destinations aim to secure coverage for shipments from March onward.

Middle East: January shipments totaled 22.6 million pounds, representing an 18% decrease compared to the same time last year. However, year-to-date shipments in the Middle East continue to surpass last year’s figures, totaling 197.3 million pounds—up 25% year-over-year. January marks the first month since August 2024 that shipments to the region did not exceed 25 million pounds. Despite destination markets in Dubai and Mersin having sufficient stocks, the region continues to secure additional commitments, with significant activity observed over the past two weeks leading up to the report. With Ramadan starting in early March, buyers in the region will soon begin planning for their post-celebration needs. In addition, many Saudi buyers have returned recently to secure anticipated demand for Hajj, which is scheduled for early June. Overall, demand remains robust as we approach the annual Gulfood tradeshow.

Domestic: January shipments totaled 61.65 million pounds; a 2% decrease compared to the same period last year. Domestic shipments now stand at 357.5 million pounds, down 1% from the prior year. In January, buyers were active in the market, contracting a strong 90 million pounds, up from 47 million pounds in the previous year. Current commitments amount to 248.8 million pounds, trailing last year by 5%, but reflecting a 15% increase from December. As pricing stabilizes, with potential for further firming based on supply and demand dynamics, buyers have begun committing longer time horizons. We expect this trend to continue in the coming month.

COMMITMENTS

Total commitments reached 571.6 million pounds, slightly below last year’s level, reflecting a 10% decrease compared to the previous year. Both domestic and export commitments are lower, with export commitments down by 14%. Uncommitted inventories continue to decrease as the year progresses, but still remain slightly higher, up 3.8% from last year. January saw a more active month for securing new sales, with total sales reaching 239 million pounds, marking a 31% increase over the previous month and a 1% rise compared to last year. Assuming a 2.7-billion-pound crop, current shipments and commitments now account for 56% of total supply, compared to 63% last year. This reflects a more cautious pace, with available supply for the remainder of the year tightening.

CROP

Crop receipts have now reached 2.66 billion pounds, representing an 11.4% increase compared to last year’s total of 2.39 billion pounds. As receipts continue to come in, they are expected to approach 2.7 billion pounds, approximately 100 million pounds less than the 2.8-billion-pound Objective Estimate. This results in a slightly smaller total supply, down 1.5% compared to last year. With shipments maintaining their pace compared to last year, it is anticipated that shortages in several product categories will occur in the latter half of the year, particularly as the industry transitions into the new crop, mirroring the challenges faced in the previous year.

|

Market Perspective January proved to be another strong month, exceeding market expectations despite slight declines in both domestic and export markets. Year-to-date shipments remain flat compared to last year, maintaining a steady pace. With tight destination inventories across most regions and products moving directly to the market rather than being stored, demand is expected to continue supporting prices in the coming months. A shorter total supply than last year is likely, with the crop estimated to be ~100 million pounds below the Objective Estimate, which could lead to product shortages in the latter half of the year as the market transitions to the new crop. While buyers have maintained a short-term purchasing approach, securing coverage sooner rather than later would be prudent to ensure a continuous supply. The almond bloom is upon us, and the market is closely monitoring weather patterns and new developments while starting to forecast the potential of the 2025 crop. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here