Laura Gerhard

Vice President

OVERVIEW

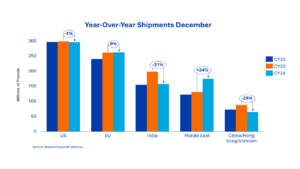

December shipments were in line with market expectations, reaching 233 million pounds, a 1.6% increase compared to last year. Export shipments led slightly, totaling 177 million pounds, reflecting a 2% increase over the previous year. Domestic shipments showed a 1% decline for the month. As anticipated, shipments are recovering from the light volumes seen in the first two months and continue to match last year’s performance.

SHIPMENTS

India: December shipments totaled 34.6 million pounds, up 70% from the record low last month but down 10% compared to last year. The year-to-date gap has narrowed to 21%, with total shipments at 157 million pounds, compared to 198.4 million pounds at this time last year. Local sales have been strong across all channels, driven by the approaching wedding season, which has depleted inventories. As November shipments reach their destinations, buyers will soon realize that inventory remains tight. Buying activity in California has picked up as buyers begin replenishing their inventories.

China/Hong Kong/Vietnam: Shipments to the region for the month totaled 7.1 million pounds, a 45% decrease compared to last year. Year-to-date shipments trail last year by 26%, widening the gap by an additional 4% since last month. Chinese buyers continue to seek alternative supply sources to bypass U.S. tariffs, which explains the increase in shipments from several Southeast Asian countries. Regional buyers have shown renewed interest, likely in anticipation of increased consumption during the Chinese New Year festivities at the end of January. However, demand from China for California almonds is expected to remain limited in the coming months, as they turn to Australia as their primary supply source.

Europe: Shipments to Europe totaled 64.3 million pounds, a 3% increase compared to last year, bringing year-to-date shipments nearly in line with last year’s totals. While demand remains steady, several countries on the continent are showing mixed signals. Spain continues to lag when compared to last year, while the Netherlands has experienced robust growth. Germany and the UK are also trailing compared to the prior year, while France is showing an increase. With local stocks now becoming available and many California sellers offering European grades, we expect demand to remain relatively flat.

Middle East: The Middle East posted another strong month of shipments, totaling 26.6 million pounds, a 13% increase compared to last year. Year-to-date shipments are now ahead of last year by 33.8%, totaling 174.7 million pounds. In the past couple of weeks, buying interest has picked up following the holiday lull, with a focus on February shipments. Turkey (65%), the UAE (11%), and Saudi Arabia (84%) have all seen significant year-over-year growth, demonstrating the region’s strong demand for California almonds. With healthy local stocks, in-country prices are currently being offered lower than California’s. As local stocks continue to deplete, the need for replenishment will follow, signaling that sustained demand in the coming weeks is expected.

Domestic: December shipments totaled 56 million pounds, 1% behind last year. Year-to-date domestic shipments are at 296 million pounds, down 1% compared to the prior year. New sales for the domestic market in December were 58 million pounds, compared to 65 million pounds last year. Commitments for the largest market currently stand at 220 million pounds, lagging last year by 20.7% due to the hand-to-mouth purchasing strategy employed by buyers. With no sign of price softening, expect buyers who have been waiting to secure coverage to come to market in the coming weeks.

COMMITMENTS

Total commitments reached 561.2 million pounds, slightly below last year’s level, reflecting an 11.96% decrease compared to the previous year. Both domestic and export commitments are lower, with exports down by 5%. Uncommitted inventories have increased to 1.3 million pounds, up 9.9% from last year. New sales totaled 182.5 million pounds, a 17% decrease compared to last year, indicating the continuation of a short-term buying strategy across regions. Assuming a 2.8-billion-pound crop, current shipments and commitments account for 53% of total supply, compared to 56% last year.

CROP

This year’s harvest is complete, with crop receipts totaling 2.58 billion pounds, reflecting a 15.6% increase compared to last year’s 2.23 billion pounds. However, it’s important to note that last year’s harvest was delayed due to weather conditions. When including the average receipts from January to July at approximately 174 million pounds, the crop estimate comes to around 2.75 billion pounds. This aligns with industry expectations, and it seems unlikely that the harvest will exceed the 2.8-billion-pound Objective Estimate at this point.

|

Market Perspective December shipments met market expectations, and year-to-date performance is on par with last year’s pace. Sellers are gaining confidence as the crop is delivered and prices continue to rise. Similarly, buyers are adjusting to higher prices and becoming more assured in their purchases. Destination inventories remain tight, with incoming products going directly to market instead of being stored, indicating strong demand that is likely to sustain prices into the new year. The next key milestone will be the almond bloom in February, when the industry will begin assessing the prospects of the 2024 crop. Look forward to connecting with you at the PTNPA conference in Scottsdale. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here