Laura Gerhard

Vice President

OVERVIEW

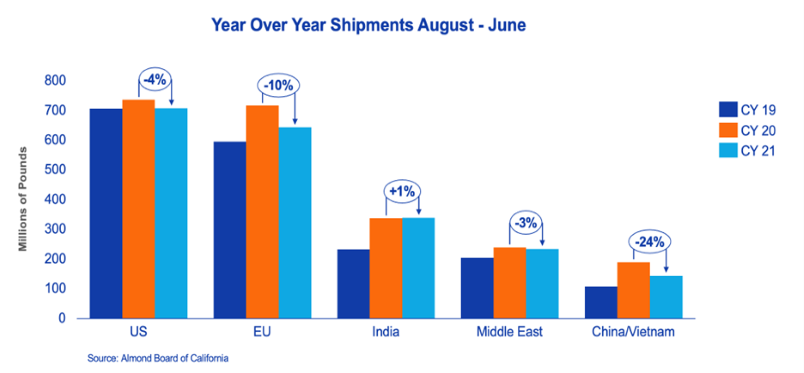

June shipments continued the trend of month-over-month increases, exceeding the high side of market expectations and marking the second largest shipment month in history. Shipments for the month totaled 279 million lbs which exceeded last year’s shipments by 26% and set a new monthly record for the second month in the row. The industry continues to find success executing on container shipments exporting an impressive 215 million lbs for the month. This is 38% higher than last year and the second largest month on record. Domestic shipments remain consistent at 64 million lbs, down 2% versus last year. Year-to-date shipments now total 2.46 billion lbs which is 8% behind last year.

SHIPMENTS

India: Shipments to India for the month were 38.3 million lbs compared to 14.3 million lbs for last June. Delayed shipments from previous months are finally reaching the market. Year-to-date shipments stand at 339.5 million lbs, exceeding last year’s 337.6 million pounds. Current crop buying has been steady over the last few months to assure inventory in time for Diwali. India will start to buy new crop for consumption after Diwali as the market is expecting strong demand all year.

China: Shipments to China for the month totaled 8.2 million lbs, up 33% to last year. Year-to-date shipments continue to trail prior year by 25%. Buyers look to get new crop purchases on the books to ensure on-time arrival for Singles Day and Chinese New Year holidays. With the Chinese New Year falling in January this year there is less room for shipping delays. Buyers are having to balance the need for immediate shipment against the inclination to remain conservative in the face of demand uncertainty from COVID-related restrictions and inflation.

Europe: June set a new record for a single month of shipments of 82.7 million pounds. Following last year’s trend, the European market continues to ship heavily not only to assure supply for fall and winter months, but also to take advantage of very attractive almond prices over the last several months. The market appears to be very well covered for the remainder of the calendar year with limited appetite to take further coverage. The Euro hit 20-year lows and when combined with the continued crisis in the Ukraine and additional inflationary pressures, many buyers have shown concern regarding demand in the region. A similar shipment pattern to last crop season is evolving, with lighter shipments in the 1st quarter given strong inventory positions.

Middle East: Shipments to the Middle East were up 83% versus last season as the industry was finally able to better execute a back log of shipments. As the market has completed its various holidays, the Middle East now has plenty of almonds in transit to restock going into the new crop season.

Domestic: Demand remains relatively steady with shipments for the month coming in at 63.9 million lbs, just 2% behind prior year. This puts year-to-date shipments 4% behind last year’s record pace. With shipments averaging approximately 64 million lbs per month (a pace similar to crop year 2019), domestic consumption this crop year would suggest a return to previous demand patterns. The market is beginning to focus on new crop and navigating the variations seen in demand by various categories.

COMMITMENTS

Total committed shipments for the crop year equal 454 million lbs and are down 8% from last June. New sales for current crop were steady versus the prior month at 119 million lbs compared with 109 million lbs last year. Uncommitted inventory backed off to 546 million lbs but is still 67% higher than last year at this time. Sold and shipped as a percent of total supply continues to lag at 84% versus 91% last year. Given the industry’s recent success in executing container shipments, the carryout now has a good chance to break below 800 million pounds. This was unthinkable just four months ago when a carryout over 900 million lbs seemed imminent.

New crop commitments for the month were reported at 107 million lbs against 95 million lbs last year. This brings the year-to-date commitment total for the 2022 crop year to 236 million lbs which is down 28% to last year. This decrease is attributed to less export sales which are down 51% versus last year.

CROP

Last week USDA NASS published its Objective Estimate forecasting the 2022 crop at 2.6 billion lbs on 1.37 million bearing acres. This is down from the May Subjective Estimate of 2.8 billion lbs on concerns of persistent drought conditions and water availability. Over the coming weeks, the industry will continue to evaluate the estimates for the upcoming crop.

|

Market Perspective Shipping momentum continued into June turning in the largest month of the crop year as the industry continues to find success executing on the backlog. Export shipments continue to impress while domestic shipments remain reliable. The strong shipments of recent months are paving the way to end the crop year with a more tolerable carryout. This is welcome news as the industry prepares to receive the 2022 harvest. Price saw the lowest levels of this crop season thus far during June and early July. Market activity had been quiet leading up to the Objective Estimate. Price direction will become clearer in the coming days as the market digests this new information. Demand headwinds persist as the world economy grapples with inflation, increased energy costs and a strong US dollar. Market activity remains focused on current crop sales to drive down the uncommitted inventory position. The industry will continue to evaluate the 2022 crop leading up to harvest with the first new crop receipts being as early as late July. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here