Laura Gerhard

Vice President

OVERVIEW

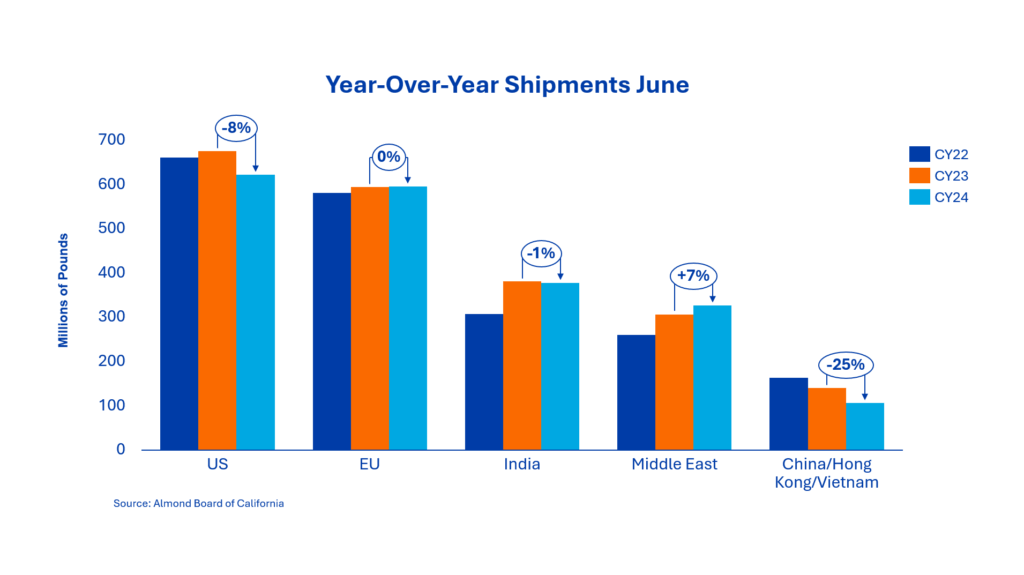

June shipments totaled 186.7 million pounds, slightly below industry expectations and down 9% year-over-year. Exports came in at 135 million pounds, just below last year’s level, though the year-to-date pace remains on par. Domestic shipments continued their downward trend, falling 17% for the month, further weighing on total industry movement. Cumulative shipments now stand at 2.449 billion pounds, down 2.5% from the same period last year.

SHIPMENTS

India: June shipments to India totaled 34.7 million pounds, up 29% year-over-year. This brings year-to-date exports to 377.2 million pounds, narrowing the shipment gap to just 1% compared to last season. India remained a key demand driver for the industry in June, with buyers pulling forward volume ahead of an early Diwali.

Timely shipments remain essential to meet festival demand. While some coverage is still pending, attention is shifting to the new crop following the Objective Estimate, which signals a larger-than-expected supply. Despite this, buyer sentiment is cautious, with a strong focus now on harvest execution, sizing, and quality which will shape pricing and forward coverage strategies into year-end.

China/Hong Kong/Vietnam: Shipments into the China–Hong Kong–Vietnam corridor totaled just under 6.5 million pounds in June, up 17% year-over-year. Despite the monthly gain, year-to-date volumes remain down 24.5%, highlighting the continued impact of tariffs on California’s competitiveness in the region. Among the trio, Vietnam has emerged as the more reliable entry point for U.S. product into Asia. On the mainland, Chinese buyers continue to favor Australian origin, benefiting from zero-duty access and competitive freight lanes. However, with Australia’s crop outlook weakening, some buyers are starting to reassess forward coverage which may lead to opportunistic demand may return to U.S. origin, particularly for spec-specific or gap-fill volumes, contingent on favorable price movements. For now, the market remains in a holding pattern.

Europe: June shipments to Europe reached 44.4 million pounds, a modest 2% increase versus last year. Despite a sluggish start to the season, cumulative shipments are now tracking flat year-over-year. Intra-regional dynamics have shifted, with Spain retaining its top position despite an 11% YTD decline. With the Objective Estimate now released and indicating a potentially larger crop, buyers are expected to begin evaluating new crop positions. However, the pending decision on EU tariff enforcement, now postponed until August, is likely to curb near-term purchasing activity as market participants adopt a cautious stance.

Middle East: Shipments to the Middle East fell sharply in June, totaling 19.4 million pounds—a decline of over 30% year-over-year. This pullback reflects the impact of regional instability and geopolitical tensions, which have disrupted near-term demand. Despite the weak June performance, YTD shipments are up 7%, bolstered by strong performance in Jordan, Turkey, and Saudi Arabia. Looking ahead, with Ramadan expected to fall early in 2026, forward demand is anticipated to accelerate as buyers seek to secure early shipments from the 2025 crop to ensure sufficient coverage.

Domestic: June domestic shipments totaled 51.4 million pounds, a 17.2% decline from the same month last year. This brings domestic shipments year-to-date to 621 million pounds, down 8% from the prior year. In crop year 2023, USDA support contributed approximately 20 million pounds to the market, the majority of which shipped by the end of June. While this assistance offered short-term relief, underlying domestic demand remains soft, challenged by broader economic conditions and shifting consumer purchasing behavior. Going forward, it will be critical to reaffirm the value and versatility of almonds across all product categories to support consumer engagement and drive demand.

COMMITMENTS

Total commitments reached 312 million pounds, showing a 10% decline compared to the previous year. New sales for the month were 96.6 million pounds, representing a 5% increase year-over-year. Current shipments and commitments now account for 87.4% of total supply, slightly below last year’s pace of 89.4%.

New crop sales are reported at 111.5 million pounds, down sharply from 271 million pounds at this time last year. Ongoing uncertainty around tariffs and crop size continues to be a limiting factor in forward bookings.

CROP

The 2025 California Almond Objective Measurement Report by USDA NASS forecasts the crop at 3.0 billion pounds, up from the 2.8 billion-pound Subjective Estimate and the 2.7 billion-pound 2024 crop. This projection is based on 1.39 million bearing acres and a yield of 2,160 pounds per acre. However, many in the industry view this forecast as potentially overestimated, citing recent declines in new plantings and ongoing pressure on grower profitability. These challenges have led to reduced inputs that have impaired the productivity of a significant number of orchards and even the abandonment of some, potentially creating a gap between reported acreage and actual harvestable land.

The projected yield also exceeds the 10- and 15- year weighted averages. As harvest progresses, industry focus will remain on receipts and realized yields to assess whether actual production aligns with or diverges from the forecast.

|

Market Perspective Heading into the report, the supply and demand balance appeared relatively stable. However, softer late-season shipments suggest a slightly higher carryout in the mid-500 million-pound range, translating to a manageable 19% carryout-to-shipments ratio. While many looked to the Objective Report for clearer direction, its release has instead introduced greater uncertainty, with widespread belief that the forecast is overestimated. Market discovery in the coming weeks may prove difficult, particularly with added complexity from the extended tariff review under Trump’s trade policy. As a result, hand-to-mouth buying is expected to continue as the industry closely monitors receipts and actual production against forecasted levels. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here