Laura Gerhard

Vice President

OVERVIEW

June shipments met industry expectations reaching 206.2 million pounds. This marks a 9% decrease from last month and a 10.5% increase from the same time last year. Domestic shipments were 62.0 million pounds reflecting a 2% increase over last year, while export shipments were up 15% compared to last year at 144.1 million pounds. These results continue the theme of strong shipments observed throughout the season, leading to a year-to-date shipment increase of 5.7% compared to the previous season. With one month remaining in the crop year, the industry is on pace to ship over 2.7 billion pounds, ending the year with a carryout around 485 million pounds.

SHIPMENTS

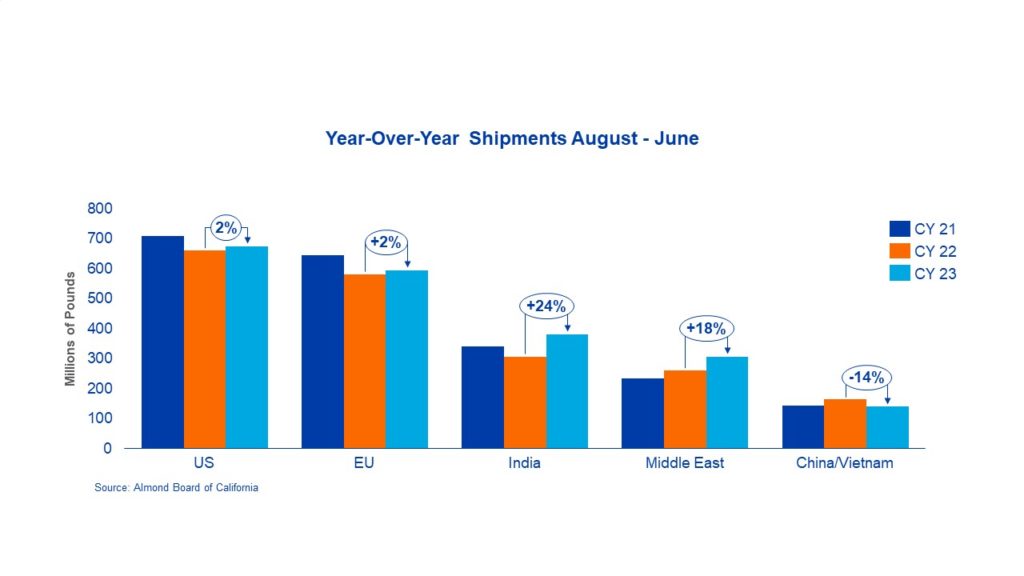

India: India continues its strong pace with 26.9 million pounds in shipments for the month, recording a 74% increase from last year. Year-to-date shipments have increased 24% compared to the previous season. Leading up to the objective estimate, buyers have been relatively quiet. However, now that the report has been released, activity is expected to resume. With a smaller crop projection, California prices are firming, making local Indian prices more attractive and likely to drive increased demand. Additionally, an earlier Diwali festival is expected to further boost demand.

China/Hong Kong/Vietnam: Shipments to the region are still facing obstacles, amounting to 5.5 million pounds for the month. This marks a 52% decrease compared to last year and a 14% decrease year-to-date. Lower than usual demand continues to challenge the region with buyers remaining quiet in June after an active May. At present, local prices are lower than California offers. Buyers are expected to maintain a cautious approach until demand increases. The upcoming Mid-Autumn festival in September is expected to present an opportunity for improvement.

Europe: Shipments to the region totaled 43.5 million pounds, an 11% decrease compared to last year with year-to-date shipments 2% higher than the previous season. Similar to other regions, market activity was quiet in the 2 weeks preceding the Objective Estimate. Buyers awaited the forecast to instill some confidence that prices would not dip from their current levels. Buying activity is expected to increase as this region has more demand to fulfill to cover new crop supplies.

Middle East: This region continues to show persistent growth with June shipments of 31.3 million pounds, marking a 145% increase from last year and an 18% increase year-to-date. Following the Objective Estimate, many in the market adopted a cautious approach. Buyers have their short-term needs covered and will wait for price stability before making further decisions. Overall, demand is expected to remain steady into the new crop.

Domestic: June shipments reached over 62 million pounds continuing the upward trend for the third consecutive month, with a 1.9% increase from June 2023. Year-to-date domestic shipments totaled 675 million pounds; a 2% increase compared to last year. The industry needs to ship 41.4 million pounds in July to match last year’s total. Following three years of declining shipments, we expect July to solidify year-over-year growth.

COMMITMENTS

Total committed shipments are 347 million pounds, a 23% decrease compared to last year. Uncommitted inventories now stand at 338 million pounds, 36% lower than last year. New sales for the current crop have reached 92 million pounds, down 40% compared to last year which is attributed to the limited pre-Objective Estimate activity. Year-to-date sales after 11 months are 5% higher than last season. Year-to-date new crop sales are 122% higher at 271 million pounds compared to the previous year.

Assuming a 2.44-billion-pound crop, shipments and commitments now account for 91% of total supply compared to 84% from the previous year. The industry is on pace to achieve a carryout of around 485 million pounds. This estimation factors in a 2% loss and exempt but actual damage this season has been greater than 4%. The additional damage will impact the 2024 carry-in driving this number down below 450 million pounds. This would put stocks/use ratios at 16% to 17%, a level not observed in the past five years.

CROP

On July 10th, the USDA Objective Estimate was published forecasting 2.8 billion pounds for the 2024 crop. This projection is 7% lower than the Subjective Estimate and 13% higher to the 2023 crop. The forecast is based on 1.38 million bearing acres. This estimate unquestionably caught the market by surprise, prompting prices to firm since its release.

Crop development and quality remain a top focus for the industry. Recent heatwaves in California have raised concerns about the impact on the maturing crop, chief among them being a slowdown or halting of the hull split stage. A prolonged hull split may increase susceptibility to insect damage, a concern already on the minds of growers. The impact on harvest timing remains uncertain at this point.

|

Market Perspective The June position report met industry expectations and maintained a strong pace as the crop year nears its end. Remaining inventories consists of lower quality almonds, leading to limited offers and making for a tight transition to the new crop. The Objective Estimate firmed prices with a smaller forecasted 2024 crop. This, coupled with a favorable carryout, will draw supply closer to demand and contribute to price stability in the global market. With minimal inventories at destination, demand is expected to persist in the weeks leading into the harvest. Moving forward, the industry will continue to evaluate the 2024 crop. Post Objective Estimate our attention now turns to price discovery as market activity is expected to increase in the upcoming weeks. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here