Laura Gerhard

Vice President

OVERVIEW

May shipments slightly fell short of industry expectations, totaling 211 million pounds, which is a 6% decrease compared to last year. Export shipments remained solid at 160 million pounds, matching last year’s figures and keeping the year-to-date pace in line with last year’s performance. However, domestic shipments experienced a 22% decline, with the ongoing downward trend in recent months impacting total shipments. Year-to-date shipments now stand at just over 2.26 billion pounds, reflecting a 1.9% decline compared to the same period last year.

SHIPMENTS

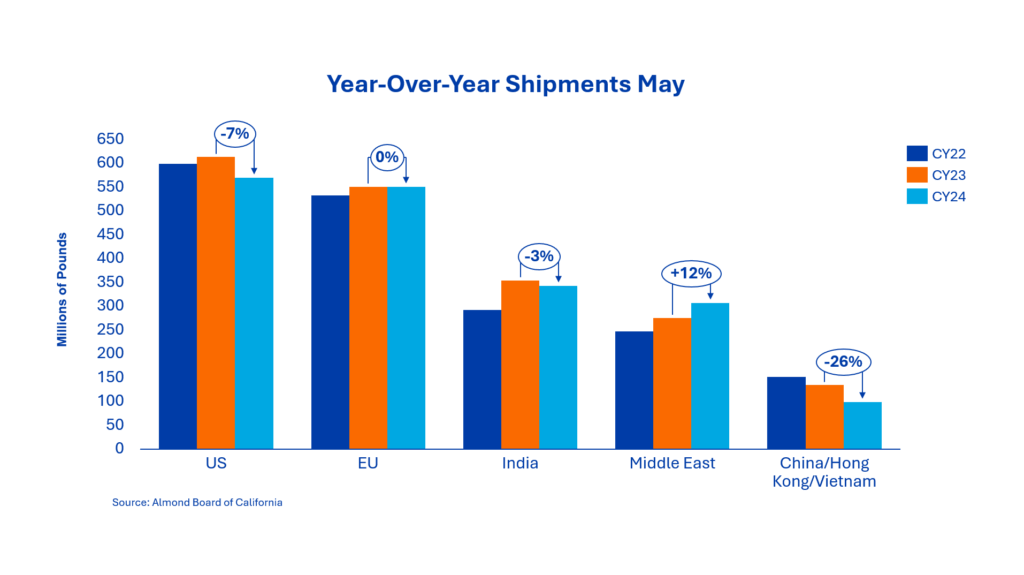

India: May shipments totaled 35.4 million pounds, down 23% from the previous month but up 9% year-over-year. The year-to-date shipment gap now stands at 3%, with total shipments reaching 342.4 million pounds compared to 353.6 million pounds at the same time last year. India continues to build inventory in preparation for the early Diwali holiday in 2025. The general market consensus is that product must ship by mid-July to arrive in time for the festivities. With demand expected to remain strong through the summer crop transition, tightening inventories in California may make it more difficult for buyers to secure their preferred sizes. New crop trading remains limited, as handlers remain focused on clearing the balance of 2024 crop volumes.

China/Hong Kong/Vietnam: Shipments to the region totaled 9.0 million pounds for the month, a slight 0.6% decrease compared to last year. Year-to-date shipments are down 26%, as tariffs continue to weigh on new sales into the region. Vietnam has emerged as a significant value-added hub, importing 15.9 million more pounds of almonds this crop year than the previous one—a 46.4% year-over-year increase through May. Much of this product is processed and re-exported to China. Singapore and Malaysia have also posted strong gains, with import volumes up 80% and 44.0%, respectively. Overall, Southeast Asia has grown over 28% year-to-date. Other markets such as Thailand, Indonesia, and the Philippines remain relatively flat. Despite tariffs being reduced to 45% for both inshell and kernel almonds entering China, only limited volumes have made their way directly into the market. China/Hong Kong shipments are down roughly 50% compared to this time last year, with inshell volumes notably absent from May’s report. Taiwan, by contrast, has seen a 27% increase in year-to-date shipments. Southeast Asia was already trending upward prior to the escalation in U.S.–China trade tensions. However, Chinese buyers have increasingly turned to alternative origins—most notably Australia—where tariff advantages continue to drive purchasing decisions.

Europe: Europe recorded 51.6 million pounds in May, a 7% increase compared to May 2024. On a year-to-date basis, the region is now flat versus the prior year, despite mixed performances across individual countries. Germany and Spain remain down double digits year-over-year, while the Netherlands and Italy have shown significant growth. Following earlier periods of active buying, recent demand has been subdued amid ongoing uncertainty surrounding potential tariffs. Should clarity emerge soon, the region may see an uptick in activity to close out the crop year, particularly as buyers look to take advantage of the recent price softness.

Middle East: The Middle East continues to perform well, with May shipments totaling 31.3 million pounds, up 2% compared to May 2024. On a year-to-date basis, the region remains up double-digits, reflecting sustained strong demand for California almonds—up 12% year-over-year. Growth has been driven primarily by the UAE, Turkey, and the Kingdom of Saudi Arabia. Destination prices in the UAE and Mersin remain below origin levels, with discounts ranging from 15 to 20 cents per pound. As we enter the summer months, consumption is expected to slow, so it will be important to watch whether the region can maintain its current pace. With Eid al-Adha concluded, buyers are expected to return to the market this week following the shipment report. Many already have coverage through the end of the year and will likely begin securing new crop volumes to ensure they are well-positioned ahead of the early Ramadan holiday.

Domestic: May shipments totaled 51.03 million pounds, down 22.3% from the same period last year, bringing year-to-date shipments to 569.8 million pounds—a 7% decline compared to the prior year. The domestic market has now experienced seven consecutive months of year-over-year declines, with double-digit decreases recorded in each of the past three months. However, booking activity is expected to increase in the lead-up to the Objective Estimate, as buyers seek to capitalize on recent price reductions.

COMMITMENTS

Total commitments reached 402 million pounds, showing a 12.7% decline compared to the previous year. New sales for the month were relatively weak at 89 million pounds, representing a 34% decrease year-over-year. Current shipments and commitments now account for 84.3% of total supply, slightly below last year’s pace of 86.5%. The industry is still expected to face a similar tight carryout as experienced last year.

New crop sales are reported at 65.7 million pounds, down sharply from 173 million pounds at this time last year. Ongoing uncertainty around tariffs and crop size continues to be a limiting factor in forward bookings.

CROP

The market continues to monitor the crop, awaiting further clarification with the release of the Objective Estimate on July 10th.

|

Market Perspective Overall, market fundamentals remain solid, with another tight carryout projected—mirroring last year. Global demand continues to be strong across most export regions, with further growth expected in India and the Middle East. However, uncertainty surrounding potential tariff changes and the 2025 crop outlook is contributing to subdued market activity, as buyers maintain a hand-to-mouth approach to contracting. This cautious behavior is applying downward pressure on prices, which are expected to stabilize as greater clarity emerges following the upcoming NASS Objective Estimate. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here