Laura Gerhard

Vice President

OVERVIEW

February shipments met market expectations, totaling 214.9 million pounds. Export shipments were slightly lower at 158.7 million pounds, reflecting a 2% decrease year-over-year, while domestic shipments saw a 4% decrease for the month. Despite these declines, strong performance in February has kept year-to-date shipments only slightly lower at -0.8%.

SHIPMENTS

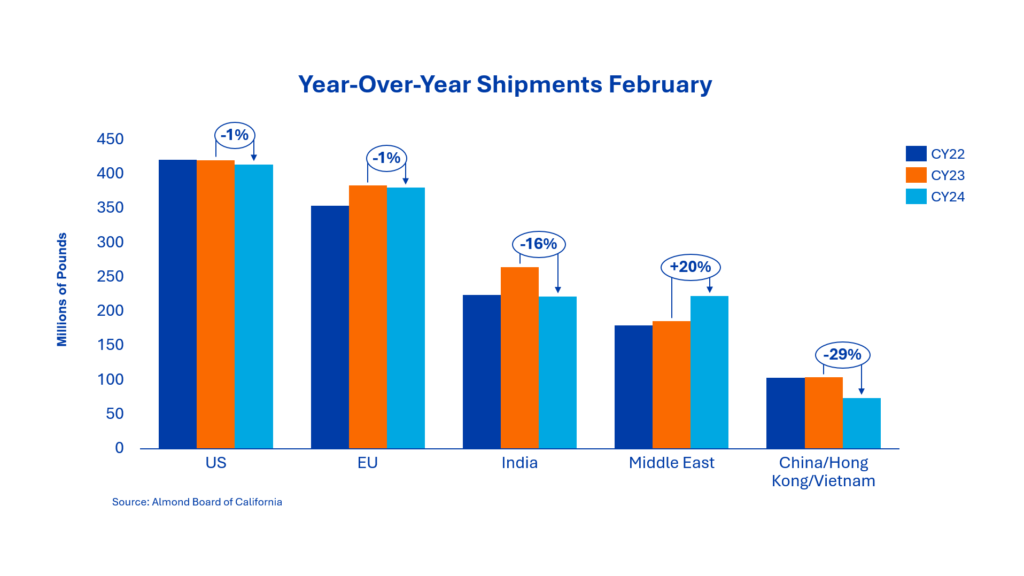

India: February shipments totaled 25.6 million pounds, down 34% from the prior month and 6% from the previous year. Year-to-date shipments trail last year by 16%, totaling 221.4 million pounds, compared to 264.6 million pounds at this time last year. With over 800 loads shipped during the month, there is still significant buying expected to cover second-half needs to have ample supply for an early Diwali.

China/Hong Kong/Vietnam: Shipments to the region totaled 3.8 million pounds in February, a 62% decrease compared to last year. Year-to-date shipments trail last year by 29%, largely due to ongoing tariff challenges. Chinese buyers continue to look to Australia for most of their needs, while Hong Kong traders continue to move volumes into Southeast Asia, supporting a 28% year-over-year increase in shipments to Vietnam. With geopolitical uncertainty, traders are exploring alternative avenues to keep buyers supplied through the rest of the year.

Europe: European shipments in February totaled 60.7 million pounds, down 1% from the same period last year. Year-to-date shipments are behind by just 1%. Demand for processor-grade almonds remains strong, with offers being difficult to come by, which has led to price increases for standard almonds. The recent announcement of retaliatory tariffs may cause some buyers to pause as they await developments. With many Spanish processors well-sold in the nearby, coverage will be needed from California, placing buyers in a precarious position as the uncertainty continues to build.

Middle East: Shipments totaled 24.4 million pounds in February, a 10% decrease compared to last year. Year-to-date shipments remain up by 20%. The decrease was expected and should help reduce high stock levels in Mersin and Dubai. Pricing in-country has been lower than California origin for the past several weeks, but it is expected to rise as higher-priced cargoes arrive. Despite Ramadan starting in late February, buyers have remained active, with some making purchases to cover needs for April/May. Overall, the region is showing continued strength, with demand for California almonds still on the rise.

Domestic: February shipments reached 56.18 million pounds, 4.4% behind last year. Year-to-date shipments are now at 414 million pounds, down 1.5% from the prior year. After a record January, buyers took a step back in February, contracting 29.38 million pounds, resulting in commitments lagging last year by 16.55%. Despite this, there is still strong demand, and buyers still need to book coverage for the balance of the crop year.

COMMITMENTS

Total commitments reached 577.4 million pounds, the highest level in the last three months, though still reflecting an 8.5% decrease compared to last year. Both domestic and export commitments are lower. Buyers continue to adopt a short-term purchasing approach, yet still need to secure additional coverage, as current sales barely cover the upcoming months. New sales were strong, totaling 221 million pounds, marking a 3% increase over last year and setting a record for February. Assuming a 2.7-billion-pound crop, current shipments and commitments now account for 69% of total supply, compared to 70% last year. The industry is on track to achieve a similar tight carryout as last year.

CROP

Crop receipts have now reached 2.68 billion pounds, indicating a final crop size of approximately 2.7 billion pounds, a 1% decrease compared to last year. With shipments maintaining a steady pace, it is anticipated that product shortages will occur even sooner than last year, particularly as the transition to the new crop begins. This is already being reflected in the pricing of certain products.

Looking ahead to the 2025 crop, concerns are mounting about the ability to produce a crop larger than the previous year. Last summer’s heat caused significant stress in orchards, and ongoing water shortages and inadequate grower inputs continue to have a lasting impact. While it is still too early to draw definitive conclusions, the industry will closely monitor these factors in the coming months.

|

Market Perspective The almond market in February displayed mixed trends across regions, with total shipments aligning with market expectations. Steady demand and a tighter crop supply are leading to earlier product shortages, causing pricing to firm. Buyers continue to adopt a short-term purchasing approach, influenced by uncertainty around potential tariff impacts. Securing coverage sooner rather than later would be prudent to ensure a continuous supply. The outlook for the 2025 crop remains uncertain, with concerns about producing a crop larger than the previous year due to stress in orchards caused by last summer’s heat and ongoing water-related challenges. As the year progresses, the industry will continue to closely monitor these factors, and the impact on future supply will become clearer in the coming months. The next major milestone will be in May, when the USDA releases its Subjective Estimate. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here