Laura Gerhard

Vice President

OVERVIEW

April shipments totaled 241.1 million pounds, surpassing market expectations. Export shipments set a new monthly record at 187.8 million pounds, marking a 6% increase year-over-year, bringing the year-to-date total in line with last year’s performance. However, domestic shipments saw an 18% decline, with the downward trend over the past several months impacting total shipments. Year-to-date shipments now stand just over 2 billion pounds, reflecting a 1.4% decline compared to the same period last year.

SHIPMENTS

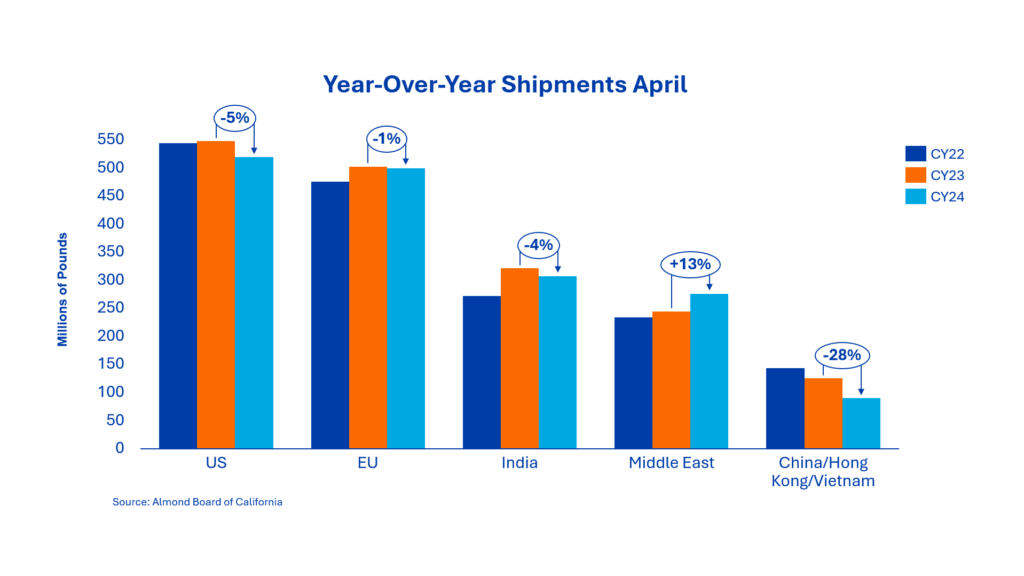

India: April shipments totaled 45.9 million pounds, marking a 16% increase from the prior month and a 39% increase from the same period last year. The year-to-date gap stands at 4%, with total shipments reaching 307 million pounds, compared to 321.1 million pounds at this time last year. The 1,400+ containers shipped during the month highlight India’s efforts to stock up ahead of the upcoming early Diwali. Despite the ongoing geopolitical shifts, India continues to source the majority of its almonds from California. Demand is expected to remain strong through the first half of July, to ensure shipments arrive before Diwali.

China/Hong Kong/Vietnam: Shipments to the region for the month totaled 9.2 million pounds, reflecting a 25% decrease compared to last year. Year-to-date shipments are trailing by 28%, as tariffs continue to impact new sales in the region. Chinese buyers are increasingly sourcing from Australia, as the tariff impact has made California almonds less competitive. With the recent announcement of a 45% U.S. tariff on shipments to China for a 90-day period, buyers may seek to hedge their positions against a potentially smaller Australian crop. Meanwhile, kernel sales into Vietnam continue to rise, driving a 45% increase in year-over-year shipments through April. It is clear that Vietnam has become the preferred destination for manufacturing, as shifting geopolitical dynamics continue to alter global trade flows.

Europe: Europe reported a total of 66.5 million pounds in shipments for April, reflecting a 23% increase year-over-year, bringing the continent’s year-to-date total to -1%. Many European buyers have maintained a hand-to-mouth purchasing approach throughout the year, which was particularly evident this month following a slow March. Two key markets, Spain and Germany, have seen declines this year, but this has been offset by growth in the Netherlands and Italy, which have increased by 28% and 10%, respectively. Both countries have now surpassed Germany in the rankings of European almond importers. With coverage for the rest of the year still pending, demand is expected to remain steady.

Middle East: The Middle East experienced another strong month of shipments, totaling 29.8 million pounds, reflecting an 8% increase compared to April 2024. Year-to-date, the region is up 13%, maintaining strong demand for California almonds and proving to be a consistent bright spot for the industry this year. Several countries in the region have seen significant growth compared to last year, with Turkey up 24%, Jordan up 39%, and Saudi Arabia up 34%. Although Turkey had a slower month in April, Mersin continues to serve as a major trade hub, along with Dubai. Buyers in the region have secured nearby coverage but will likely seek additional purchases to cover their July-forward needs as we approach the transition period before the new crop.

Domestic: April shipments totaled 53.3 million pounds, marking a 17.8% decline compared to last year, bringing year-to-date shipments to 518.8 million pounds, a 5.2% decrease from the prior year. New sales for April amounted to just over 51 million pounds, resulting in commitments of 202.5 million pounds, down 16.97% compared to crop year 2023. The domestic market has now seen six consecutive months of decline compared to the previous year, with the last two months showing declines exceeding 17%. While consumer spending and point-of-purchase decisions have moderated, there is potential for stabilization in the coming months.

COMMITMENTS

Total commitments amounted to 581 million pounds; a 5% decrease compared to the previous year. New sales for the month reached 192.5 million pounds, reflecting a 12% decline year-over-year. Current shipments and commitments now represent 81.6% of total supply, slightly trailing last year’s pace with three months remaining in the crop year. The industry is on track to experience a similar tight carryout to last year, with projections of just under 500 million pounds.

CROP

The 2025 Subjective Estimate, released on May 12, forecasts a crop of 2.8 billion pounds, based on 1.39 million bearing acres and an implied yield of 2,010 pounds per acre, slightly below the five-year average. Assuming crop production reaches the high end of industry estimates at 2.8 billion pounds, the industry is still expected to maintain a balanced supply and demand landscape through next year and points to price stabilization as we approach the new crop. The market will wait for further clarification on the crop with Objective Estimate in July.

|

Market Perspective Overall, the market outlook for the coming months remains positive, supported by sustained global demand and tight supply as we approach the final months of the crop year. This should help stabilize prices heading into the new crop. While uncertainties remain, particularly regarding potential tariff changes and the outlook for the 2025 crop, robust demand in key export markets such as India and the Middle East is expected to drive growth. It would be wise for buyers to secure coverage sooner rather than later to mitigate the risks of supply shortages and price fluctuations. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here