OVERVIEW

For the third month of the crop year, industry shipments totaled 249.2 million pounds, reflecting a 26% increase from last month, though 3.6% lower than the same period last year. Exports reached 201 million pounds, marking a 36% increase from last month, and a 5.2% increase compared to last year. This indicates continued strength in the international marketplace. Domestic shipments reached 48.2 million pounds, a 2.7% decrease from last month and were down 28.5% versus the prior year. While overall October shipments came in slightly below market expectations, driven primarily by softness in domestic demand, the export sector continues to show resilience. Forward momentum is expected to persist as global markets move to replenish inventories ahead of the expected holiday consumption and early-year buying cycles.

SHIPMENTS

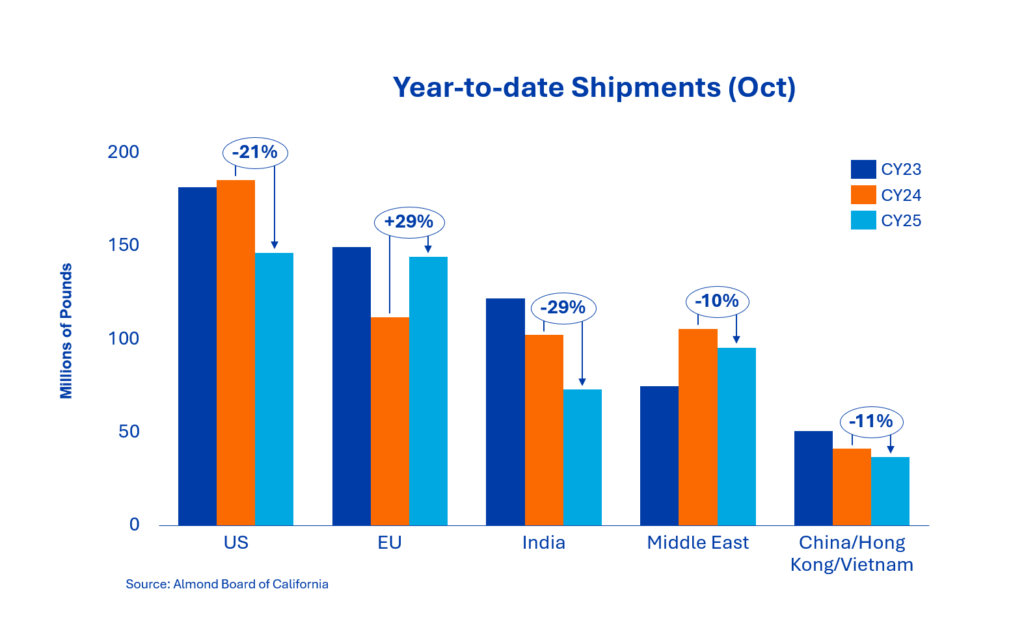

India: October shipments totaled 28.3 million pounds, nearly even with the prior month and down 4% from the prior year. The year-to-date gap is currently at 29%, with total shipments at 72.8 million pounds, compared to 102.1 million pounds at this time last year. October’s inshell shipments show that India is still hesitant to book at California origin prices as uncommitted cargo shipped from California continues to suppress the local market pricing and sentiment. The market remains under-covered, and the timing and scale of further Indian buying will be a key driver for pricing into the end of the year.

China/Hong Kong/Vietnam: October shipments into the region came in at 20.4 million pounds, with Vietnam once again carrying the load. The market continues to show upside, posting 30.1 million pounds for the month, which is 132% up for October and a 94% increase year to date, a remarkable run by any standard. On the flip side, China/Hong Kong remains soft, reflecting the structural slowdown we’ve been watching all season. Shipments were down 73% in October and 75% year to date. Combined shipments to the broader region flattened out this month, down 2% and 11% on the year. We expect to see the region pick up next month with the recent 10% tariff reduction in China.

Europe: Europe continues to be the standout growth region early into this crop year. Total shipments to Europe reached roughly 144 million pounds year to date, up about 29% versus last year. Western Europe alone is up 31%, with Spain, Italy, Germany, and the Netherlands leading the gains. Buyers remain selective and value focused, but the growth demonstrates that European demand is stepping up to absorb a meaningful share of this year’s crop.

Middle East: Shipments to the Middle East totaled 47.2 million pounds in October, down 17.4% from the prior month and 9.6% year over year. Despite the softer results, the region remains a core growth market for California almonds. While volume growth trails Europe, demand for quality products continues to improve, with buyers increasingly targeting premium grades and larger sizes.

Domestic: October shipments reached 48.2 million pounds, down 28.5% from the same period last year. The domestic market has now seen twelve consecutive months of softer demand, resulting in the market being down 21.2%. Corresponding commitments increased by just over 5% from last month with a decline from last year of 7.5%. Buyers have been assessing holiday projections and coverage through Q1 of 2026, waiting for a drop in pricing to determine when to step into the market, as there is ample demand to be covered for the forward ship periods.

COMMITMENTS

Total commitments currently stand at 561.5 million pounds, a 16.7% decrease from last year. New sales for the month totaled 261.8 million pounds with the domestic market layering in an additional 62.5 million pounds, while exports added an additional 199.3 million pounds of new coverage. In total, commitments for the domestic market now stand at 198.9 million pounds, and exports stand at 458.1 million pounds. Uncommitted inventory sits at 982.2 million pounds versus prior year 997.1 million pounds, down 1.5%.

CROP

Crop receipts through October reached 1.7 million pounds, reflecting a 7.9% decline compared to the previous crop year, largely driven by a slower receipt pace. Overall crop receipts are lighter, driven by lower Nonpareil yields and overall turnouts (kernel weight as a share of hull, shell, and kernel). Given these factors and analyzing year-over-year orchard comparisons, overall crop size will challenge even the viability of the Subjective Estimate’s 2.8-billion-pound crop. Pollinizer receipts through December will inform overall crop size. In October, growers attempted to complete in-field harvest activities, but some were delayed by a strong weather system. The storm forced growers and hullers to adjust operations, focusing on incoming field deliveries versus running stockpiles. Higher reject levels have been observed in later-harvesting varieties; however, overall reject levels are lower than the 2023 and 2024 crop years. LandIQ will publish the 2025 Standing Acreage Final Estimate in November, providing insights into orchard removals, new plantings and bearing acres. This will inform future crop potential.

|

Market Perspective The October report brought greater clarity to market fundamentals and reinforced a firming tone across the industry. At present, supply is clearly tighter than last year, and export demand continues to build momentum with shipments tracking ahead of prior-year levels. As we move through the remainder of Q4 and into early 2026, market sentiment points toward a stable-to-firm trajectory, with potential for further strength should India and other key destinations accelerate coverage. As the market transitions into a more disciplined and sustainable balance between supply and demand, confidence is returning to both sides of the trade. Stable fundamentals and consistent export performance provide a strong foundation for informed purchasing decisions and long-term value creation. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here