Laura Gerhard

Vice President

OVERVIEW

Shipments for October reached 258 million pounds, reflecting a 21% increase from last month and a 4.5% rise compared to last year. Export shipments totaled 191 million pounds, slightly surpassing last year’s figures. Domestic shipments rebounded to 67 million pounds, marking an 18% increase over last year and the highest shipment volume since March 2022 (31 months). As expected, shipments are gaining momentum following a slow start due to limited supplies, and this trend is expected to continue through November as the market focuses on fulfilling orders to various export markets for the upcoming holiday season.

SHIPMENTS

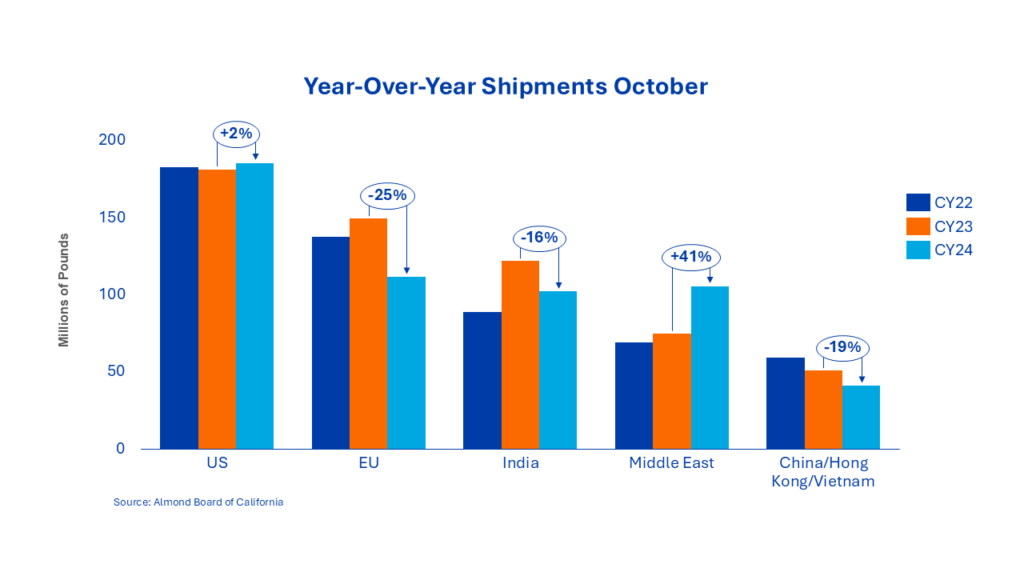

India: October shipments to India totaled 29.4 million pounds, down 39% compared to last year. Year-to-date shipments, after three months, are trailing last season by 16%, totaling 102.1 million pounds. Strong and profitable Diwali sales left the market with minimal inventories heading into the festival. In the days leading up to Diwali, buyers returned to the market, keeping inshell prices supported as they resumed purchasing at similar price levels to where they had previously left off. Container arrivals to Nhava Sheva are still experiencing delays, ensuring a steady and consistent flow of product to the market while preventing inventory buildup. Since the holiday’s conclusion, Indian buyers have remained engaged, actively purchasing to replenish stocks and sustain momentum in the post-Diwali market.

China/Hong Kong/Vietnam: Shipments to the region totaled 20.8 million pounds for the month, a 28% decrease compared to last year. Year-to-date shipments are 19% behind last year. As the Chinese New Year (CNY) festival approaches, both buyers and sellers in the almond market are focused on executing orders within the limited timeframe to ensure timely arrivals. Consumer demand showed strong performance during the recent Mid-Autumn Festival, and similar expectations are set for the CNY festival starting on January 29. In-market inventories are reported to be minimal, with buyers proceeding cautiously while still hoping for price softening. However, some buyers have opted to cover small volumes for post-CNY demand at current price levels, as inshell prices remain supported by current demand. Following the re-election of President Donald Trump, buyers are expected to maintain their cautious approach until his administration’s stance on tariffs becomes clearer.

Europe: Shipments to Europe totaled 42.1 million pounds, down just over 4% from last year, bringing year-to-date shipments to 111.7 million pounds, a 25% decline compared to the previous year. European buyers remain skeptical about higher California prices, turning to limited local supplies where available. Additionally, buyers continue to face challenges in finding sufficient offers of STD5 from California. As a result, it is likely that European buyers will maintain a hand-to-mouth purchasing approach for the foreseeable future.

Middle East: The Middle East continues to stand out for exports, with impressive shipments totaling 57.2 million pounds, a 46% increase over last year. Year-to-date shipments have surpassed 105 million pounds, reflecting a 41% increase. Many buyers are adjusting to the ongoing firmness in prices, and those who had been waiting are now moving quickly to meet remaining Ramadan needs. The UAE, Turkey, and Saudi Arabia have shown notable growth this year, with the UAE now ranking as the second-largest export market after India, followed by Turkey in third.

Domestic: October shipments reached 67.4 million pounds, 18% ahead of last year, marking the strongest month for domestic shipments since the record set in the 2020/21 crop year. This resulted in a year-over-year increase of 2%, a strong rebound from the 5% deficit following September’s results. Buyers have adopted a hand-to-mouth purchasing approach due to recent price firming, leading to domestic commitments being down 20.8% year-over-year. Despite this cautious buying strategy, new sales for the month are up 4%.

COMMITMENTS

Total commitments have improved to 673.7 million pounds, slightly below last year’s level. However, export commitments are 13% higher than last year, totaling 458.5 million pounds. This performance positions the industry well for strong shipments over the next two months as sellers work to fulfill orders. Uncommitted inventories now total 997 million pounds, up 32% from last year due to an earlier harvest. Exports continue to drive new sales, reaching 264.7 million pounds, a 6% increase over last year. Assuming a 2.8-billion-pound crop, current shipments and commitments account for 41% of total supply, compared to 42% last year.

CROP

This year’s harvest is essentially complete, with crop receipts totaling 1.85 billion pounds. By January, the industry is expected to have a clearer picture of the final crop size. Due to lower moisture levels this year, almonds moved quickly through the huller and sheller, with many facilities having already completed their work for the season. Growers are now shifting their focus to post-harvest orchard activities. Rainfall over the next two months will be crucial for replenishing orchard soils and storing water for the upcoming growing season.

|

Market Perspective Overall, the October position report presents a favorable outlook. Although results were slightly below forecasts, they were strong enough to support prices. Sellers are becoming more comfortable as the crop is delivered and prices show an upward trend. Likewise, buyers are adjusting to firmer pricing and gaining confidence that they can purchase without fearing an immediate price drop. Destination inventories remain tight, with incoming products moving directly to market rather than to storage, signaling strong demand that should continue to support prices into the new year. With the harvest now complete, the industry is closely monitoring receipts to assess the final crop size. Many believe the 2024 crop may fall short of the forecasted 2.8 billion pounds. While it’s still too early for a definitive assessment, a clearer picture should emerge by January. Additionally, many in the industry are speculating on the impact of a potential Trump victory on tariffs and future demand. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here