OVERVIEW

For the second month of the crop year, industry shipments totaled 197.3 million pounds, reflecting a 25% increase from last month, though 7.6% lower than the same period last year. Exports reached 147.7 million pounds, marking a 35% increase from last month, and a 6.3% reduction compared to last year. Domestic shipments reached 49.5 million pounds, a modest 2.2% increase over last month, and were down 11.5% versus prior year. Overall, September shipments outperformed market expectations, as limited early season supply and constrained old crop inventories had primed the market for a softer result. As new crop availability expands and buyers re-enter the market, demand is expected to remain consistent.

SHIPMENTS

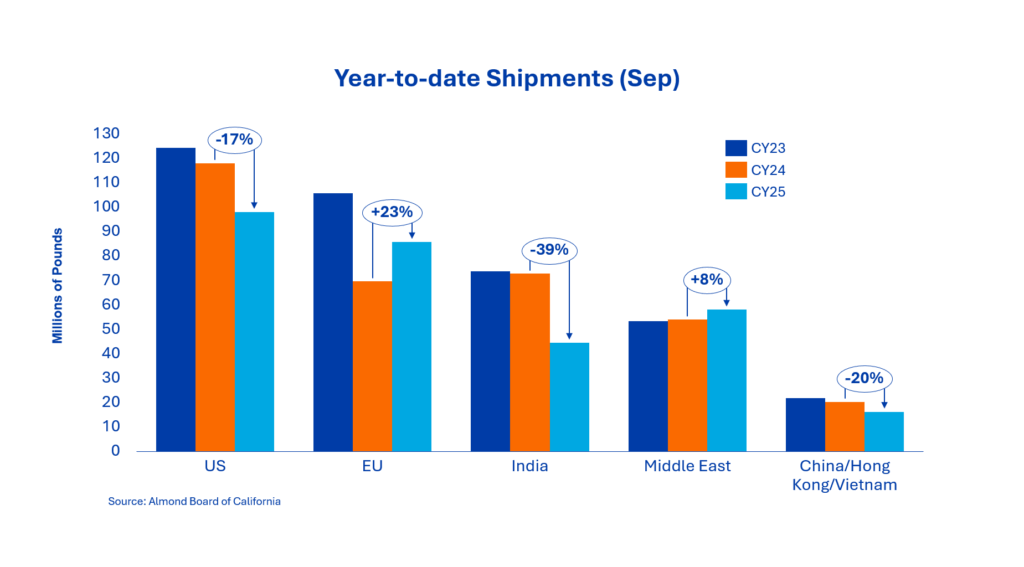

India: September shipments to India totaled 28.1 million pounds, bringing the year-to-date total to 44.5 million pounds, down 39% from the prior year. The sluggish start was driven by light early receipts and limited vessel availability. However, Indian importers have since become active in covering November shipments, as low arrivals in August and September have left local inventories tight. A substantial new buying activity in the last half of October is expected.

China/Hong Kong/Vietnam: Shipments to the broader region totaled 12.0 million pounds in September, led by Vietnam’s strong performance of 10.6 million pounds, which was an increase of 139%. China/Hong Kong experienced a sharp decline of 86% for the month with a turnout of 1.4 million pounds. The divergence reflects the ongoing trade rebalancing between direct and transshipment channels, with China maintaining conservative coverage ahead of Chinese New Year. Vietnam’s strength has been underpinned by increased kernel processing and re-export activity into Southeast Asia.

Europe: European shipments totaled just over 42 million pounds in September, bringing the year-to-date total to 85.7 million pounds, up 23% versus the same time last year. Spain and Italy led regional growth as buyers took advantage of recent price dips to secure coverage into Q4. While the overall buying approach remains disciplined and largely hand to mouth, the sentiment has improved following the ANUGA trade show, with several buyers likely to move to rebuild positions.

Middle East: Shipments to the Middle East totaled 31.0 million pounds in September, down 18.5% versus September of last year. The strong shipments in August balanced this monthly decline, resulting in flat year-to-date shipments for the region. Early Ramadan timing in 2026 continues to shape buying patterns, with importers advancing coverage earlier than usual. Reports from the marketplace indicate sustained momentum into October, with strong coverage extending into year end.

Domestic: September shipments totaled 49.5 million pounds, down 11.5% from the same period last year. This was the eleventh straight month of negative year-over-year shipments, resulting in the market being down 16.9% year to date with corresponding commitments down by 12.6%. The domestic market has been challenged economically, leading consumers to make new point-of-purchase decisions, especially in the snacking categories. Buyers continue to assess needs through the end of the year and have been cautious with hand-to-mouth purchasing.

COMMITMENTS

Total commitments currently stand at 548.9 million pounds, a 17.7% decrease from last year. New sales for the month totaled 219.6 million pounds with the domestic market layering in an additional 63.3 million pounds, and export adding an additional 156.3 million pounds of new coverage. In total, commitments for the domestic market now stand at 184.7 million pounds, and exports stand at 364.3 million pounds.

CROP

Crop receipts through September reached 992 million pounds, reflecting a 4.2% decline compared to the previous crop year. Lighter receipts are a reflection of lower yields on Nonpareils, and slower huller sheller throughput driven by increased hull moisture and thicker shells. In September, harvest progressed from Nonpareil and Independence into pollenizer varieties. There are some concerns about reject levels attributed to navel orange worm, specifically in later-harvesting varieties, but overall quality is still expected to be better than the 2023 and 2024 crop years. Year-over-year orchard comparisons on early varieties, such as Nonpareil, make a 3-billion-pound crop highly unlikely and even challenges the viability of the Subjective Estimate’s 2.8-billion-pound crop. Looking ahead, pollenizer receipts over the next couple of months will inform overall crop size. Most growers are on target to complete in-field harvest activities by the end of October while the industry will keep an eye on the upcoming California storms and the potential impacts on receipts and quality.

|

Market Perspective The market tone has stabilized following the softness seen in the last half of September. Willing sellers front-ran the September report, while buyers remained cautious, only covering nearby needs. With crop receipts tracking below prior-year pace, quality testing trending positively, and forward sales increasing, the near-term environment appears constructive. The industry is expecting a strong October, supported by renewed demand from India and Europe. While prices will likely remain rangebound in the short term, tighter supply fundamentals and consistent export demand suggest a gradual firming bias into the second half of Q4. As market participants gain better clarity on total production and sizing, execution and quality differentiation will remain key price drivers, particularly for premium Nonpareil and large count kernels. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here