OVERVIEW

The California Almond industry opened the 2025 crop year with August shipments totaling 158 million pounds, down 6.2% year-over-year. Exports saw a modest increase reaching 109 million pounds, a 2.9% rise compared to last August, while domestic shipments started the year with a double-digit decline. Overall, shipments fell short of industry expectations with tight inventories at the end of the 2024 crop. With new crop inventories now available, we anticipate September shipments to rebound.

SHIPMENTS

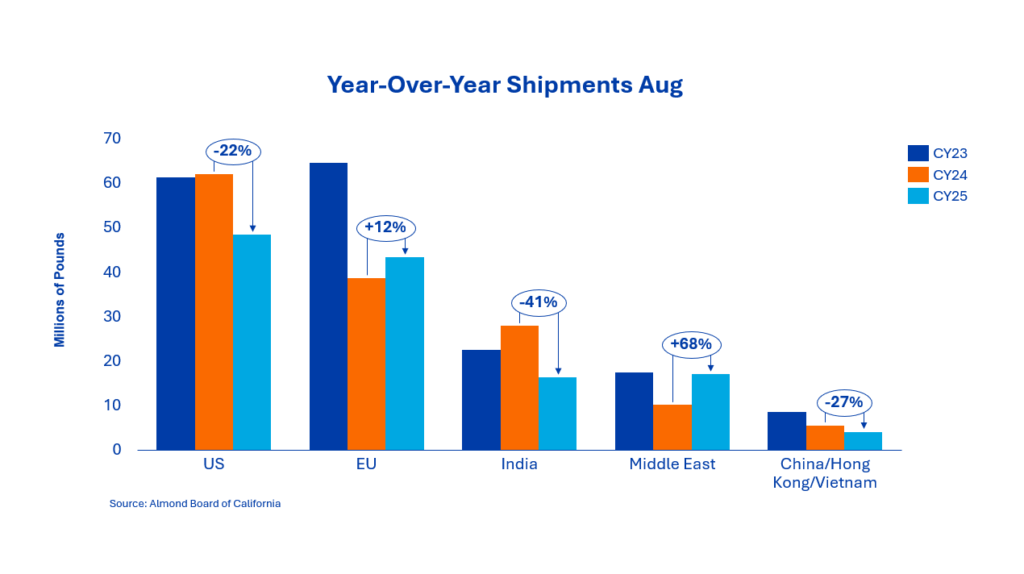

India: August almond shipments to India totaled 16.4 million pounds, marking a 41% decline year-over-year. This softer start to the 2025 crop year was anticipated, following the exceptionally strong July shipments and a slightly delayed harvest. Despite the dip in August, India remains largely uncovered for September, positioning the market for a meaningful rebound in the upcoming shipment report. As we move past the initial phase of the crop year, attention will turn to covering any remaining Diwali demand through local supply, while post-Diwali needs are expected to drive renewed interest in California almonds.

China/Hong Kong/Vietnam: Shipments to the region totaled over 4 million pounds, marking a 27% decrease compared to the same month last year. In the coming weeks, it should be expected that activity will pick up as buyers seek coverage for Chinese New Year.

Europe: The European market showed modest strength in August with shipments totaling just over 43 million pounds, which is 12% above last year. European buyers are keeping a disciplined pace, stepping in only when needed continuing a hand-to-mouth approach. The recent suspension of EU tariff measures provides some comfort for forward cover, but it has not created urgency. Sellers are releasing volume selectively, preserving the ability to capture better values once harvest clarity improves.

Middle East: The Middle East has been very active to open the 2025 crop year. Shipments reached more than 17 million pounds in August, up almost 68% vs prior year. The earlier Ramadan in 2026 is already shaping buying behavior, with importers advancing coverage well before the November shipment cutoff. Despite the activity, many have remained sidelined awaiting the August shipment report hoping to gain more clarity on the incoming crop, so activity levels are expected to remain high post-release. After the region’s strong performance in crop year 2024, it will be worth monitoring to see if it is repeatable.

Domestic: August shipments totaled 48.45 million pounds, down 21.9% from the same period last year. This was the tenth straight month of negative year-over-year shipments. We continue to see sharp declines year-over-year, despite July results which painted a more optimistic picture. New sales for the month were 55 million, a decline of 7.11% year over year. Strong domestic sales for the month were a bright spot, however there is ample demand still to be covered. Given last year’s performance, demand in the domestic market will continue to be monitored closely for signs of further declines.

COMMITMENTS

Total commitments for the year start at 526.6 million pounds, a 13.2% decrease from last year. New sales for the month totaled 184.1 million pounds with the domestic market layering in an additional 55 million pounds and export locking in 129.1 million pounds of new coverage. In total commitments for the domestic market now stand at 170.9 million pounds and exports stand at 355.7 million pounds.

CROP

Crop receipts for the year begin at 259 million pounds, reflecting a 10.7% decline compared to the previous crop year. Recent concerns have emerged regarding lower yields from the central and southern region of the valley, particularly in the early varieties such as nonpareil which account for approximately 40% of the total crop. Many in the industry doubt the feasibility of the 3.0-billion-pound Objective crop estimate and some are even speculating that the final yield could even fall below the 2.8 billion pound Subjective Estimate. Consequently, California Packers are adopting a cautious stance, limiting offers until there is greater clarity on the new crop’s potential.

|

Market Perspective The carry-in figure was the most notable surprise of this position report. The carry-out from July’s position report was adjusted with an actual loss and exempt percentage of 3.14%. This puts the official carry in at 483.8 million pounds. Additionally, this year the Almond Board of California conducted a voluntary survey regarding the edible portion of the 2025/26 carry-in inventory. Based on those results, only 92.4% of the total carry-in is estimated to be edible, bringing the number down further to an estimated 447 million pounds. With the anticipated carry-in and skepticism around the 3.0-billion-pound Objective Estimate, California is exercising caution with offered volumes. Prices have risen sharply over the last month and are expected to remain strong as buying continues in the weeks ahead. Harvest is underway, and clarity on the 2025 crop will emerge as receipts are assessed for quality, size, and overall supply potential. If you plan on attending Anuga 2025, please stop by Hall 10.2 Stand G068, the Blue Diamond Team would be glad to connect! |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here