Bill Morecraft

Senior Vice President

OVERVIEW: Monthly Shipments Continue at 125% of Prior Year

Again, in June, California almond industry shipments hit the higher end of expectations, reaching 220.4 million lbs., up 45.1 million lbs. and 25% from last year. YTD shipments are 2,669 millions lbs. With one month remaining in the fiscal year, shipments have already surpassed last year’s record and will exceed 2.8 billion lbs. by year-end.

SHIPMENTS

The increases for June shipments were concentrated in a few markets:

- U.S.: +6.7 million lbs.

- Europe: +23.3 million lbs.

- Middle East/Africa: +12.5 million lbs.

U.S. shipments were up 11.5%, bringing YTD growth to 4.4%. In May and June, the U.S. was lapping COVID-19 impacted shipments from last year and posted significant year-over-year gains in both months. Since February, the U.S. market has been returning to a demand pull more reflective of pre-COVID-19 times, with more than 65 million lbs. of shipments each month. There is increased foot traffic in both grocery and convenience channels that supports the steady growth.

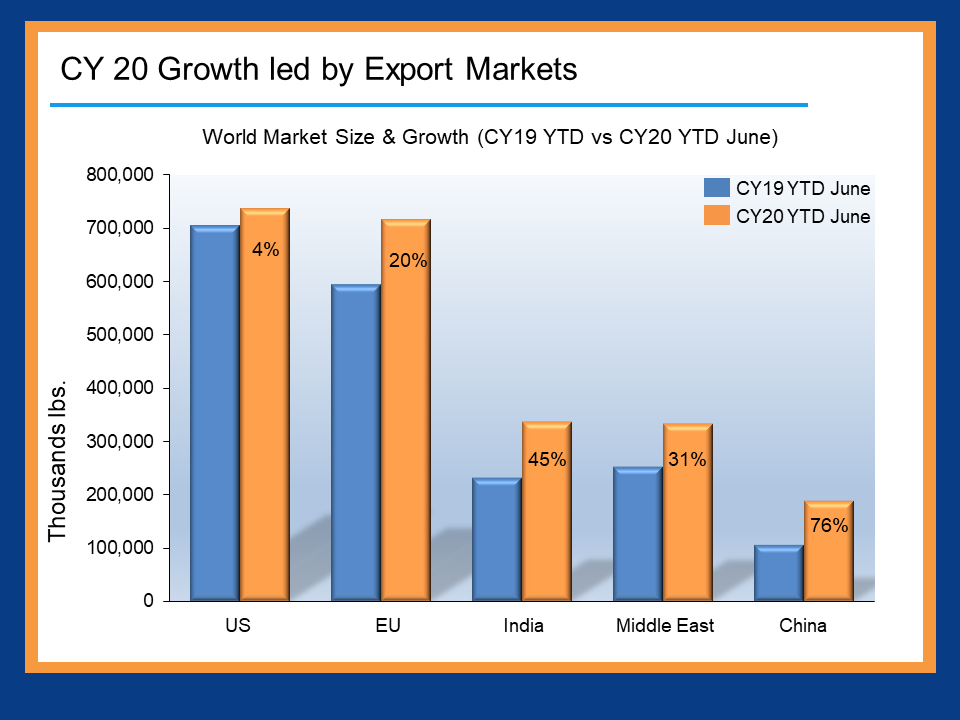

GROWTH IN EXPORT MARKETS

The driver of California industry shipment growth continues to be export markets. For June, the Asia Pacific regions slowed down for the first time all year as inshell and NPX shipments are declining due to minimal inventories. Europe and the Middle East continue to take product at a torrid pace in the latter part of the year. There is some front loading of inventory in Europe to mitigate the shipping delays that continue to be experienced. The Middle East is making up for a slow start with significant June growth in Turkey, UAE and Morocco.

CROP COMMITMENTS

2020 crop commitments are 125 million lbs. ahead of last year, primarily in export markets. New crop commitments at 326 million lbs., trail last year by 132 million lbs. Combined commitments are virtually the same as last year. The biggest change in new crop commitments appears to be a slower roll out by California of Inshell and NPX kernels after running low on unsold inventory so early this past campaign. After the Objective Estimate is delivered on Monday, July 12, the pace of activity will pick up as it typically does in late July and August.

|

Market Perspective A year of transformation… Closing out the year, a 3.5 billion lb. supply will be reduced to ~600 million lbs. of ending inventory. With annual shipments of ~2.9 billion, the 600 million lbs. nets out to moderate 75-day supply. The 20% increase in crop size has effectively been absorbed in a single year, while both buyers and sellers contended with the obstacles of COVID-19 and ocean freight congestion. In recognition of higher demand expectations and less uncertainty than global markets faced at this time last year Initial price for the 2021 crop are projected to start higher than last year. Nonpareil Inshell and NPX kernels have seen the biggest lift, with pollinizers holding steady well above their lows of last fall. Even with the increases, prices are well below competing tree nuts (e.g., cashews, pistachios) and remain at multi-year lows for California almonds. With the prospect of ongoing drought, there remains room for upside on pricing. Stay tuned for the Objective Estimate on Monday, July 12. |

For Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here