Bill Morecraft – Senior Vice President

Receipts for the 2017 almond crop trailed off significantly in February, reaching a total of 2.250 billion lbs. The remaining crop projects to trickle in just over the NASS Objective estimate, topping out at ~2.260 billion lbs. The higher insect damage in the 2017 crop leaves saleable supply a little short of 2.6 billion lbs., including the carry-in from 2016.

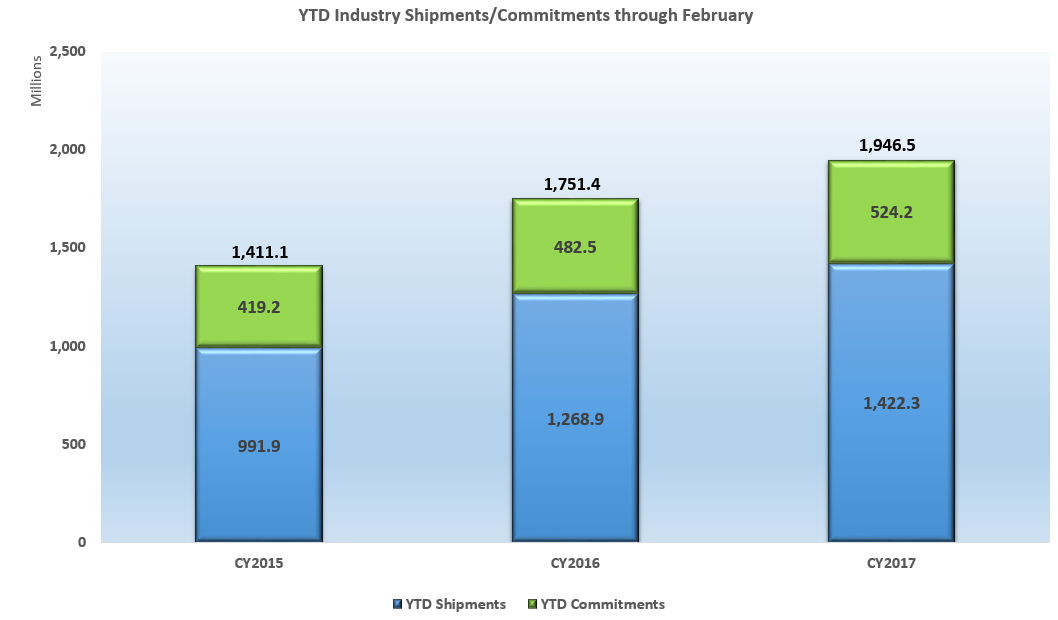

Shipments reported in the February ABC Position Report rose sharply over prior year. 190.1 million lbs. were shipped for the month, a 25% increase. YTD, shipments exceed prior year by 153 million lbs., representing a 12% increase. All major geographic regions continue to post increases. The U.S. is growing steadily at 5.7%+, China is up 21%, India up 29%, Europe up 15% and the Middle East/Africa up 5%.

New commitments increased 113 million lbs. in February, leaving YTD commitments 42 million lbs. higher than prior year, an 8.6% increase.

YTD shipments and commitments total 1,946.5 million lbs., 75% of the projected supply.

The pace of shipments should slow vs. last year for March through July, based on limited supply. Ending inventory projects to be less than last year, pointing to very tight transition as the overall shipments continue to grow.

Bloom weather, after starting warm turned unseasonably cold with more widespread freezing temperatures than previously experienced for a period of close to two weeks. While the impact is uncertain, it has reduced the overall potential for total 2018 crop supply. A more quantitative outlook on the bloom results will come later in March.

|

Market Perspective The widespread freezes during the 2018 crop bloom, coupled with continued robust growth in 2017 crop shipments have pushed short-term pricing up $.40-$.50 in the last month. The current price levels are likely to hold or increase for as long as concern for 2018 crop production persists. Demand on 2017 crop has been very strong, as indicated by the shipment and commitment data. Long-term, the continued demand growth provides a positive outlook on the absorption of production from increased acres at stable pricing. |

Click here to view the entire detailed Position Report from the Almond Board of California site: