Bill Morecraft

Senior Vice President

Shipments on the April 2018 ABC Position Report recorded growth of 16.5% over prior year, totaling 176.4 million lbs (including an adjustment to prior YTD). Revised YTD shipments are now 193 million lbs and 12% ahead of last year’s pace.

Total domestic shipments are now up 10% over prior year while export markets are up 13%. China (21%), India (23%) and Western European shipments (12%) are all up double digits.

Uncommitted inventory drops to 445 million lbs, 10% below last April. When adjusting for the higher reject level, uncommitted is closer to 420 million lbs or 15% below last year.

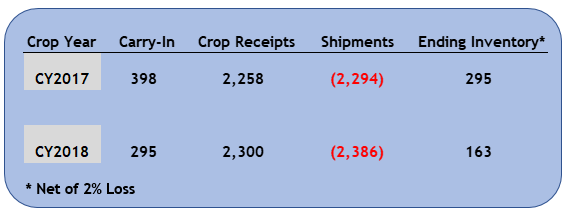

The graphic above calculates May-July shipments flat to last year, and a 2.3 billion lb 2018 crop. This is an unsupportable level of ending inventory for both years. Even with lower total commitments than last year, it is inevitable that pricing will be used as a lever to create a supportable ending inventory for both years.

Allowing for the potential of a larger Objective Estimate of 2.4 billion lbs, even conservative shipment growth next year of 4% would take ending inventory below 300 million lbs for the 2018 crop year. This would equate to less than six weeks of supply for the twelve-week transition period.

Last year the Subjective Estimate was within 3% of the actual crop.

|

Market Perspective With the NASS Subjective Estimate at 2.3 billion lbs, and continued growth in demand, the almond industry is facing historically tight supply as we transition crops. The combination of a 2.3 billion lb Subjective Estimate and yet another strong set of shipment numbers have been quickly reflected in market activity and pricing for both existing and new crop. |

See Blue Diamond’s Market Updates Online Click Here:

Click here to view the entire detailed Position Report from the Almond Board of California site: