Bill Morecraft

Senior Vice President

OVERVIEW

The California almond industry closed out the year with July shipments of 229.4 million lbs, up 49.3 million lbs (27%) over last year. YTD shipments reached 2.898 billion, up 526 million lbs from the 2019 crop. Ending inventory dipped below 600 million pounds.

SHIPMENTS

The increases for July shipments were mostly in Europe (up 25.1 million lbs) with increases across Asia-Pacific and Middle East/Africa contributing 9 million lbs each. The U.S., Canada & Mexico added another 5.2 million lbs.

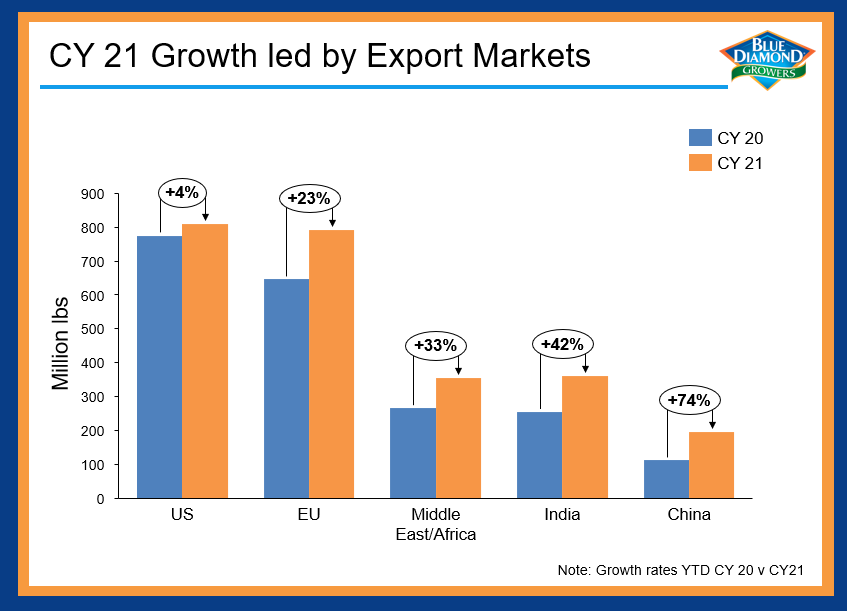

YTD, shipment growth of 526 million lbs was also led by export markets with Europe up 23% (147 million lbs), India up 42% (106 million lbs), China up 74% (80 million lbs), the rest of Asia-Pacific also increased their shipment another 42 million lbs and the Middle East/Africa up 33% (89 million lbs). The U.S grew by 4%, adding 32 million lbs.

CROP COMMITMENTS

Commitments at the end of July, include 441 million lbs of 2021 crop and 344 million lbs of 2020 crop for a total of 785 million lbs. This is down from the accelerated levels of last July by 21%, but exceed the July 2019 total of 515 million lbs by 52%. Less new crop Nonpareil kernel has been committed this year, with more pollenizer commitments in the old crop number.

HARVEST

The low kernel weights in the NASS Objective Estimate, coupled with above average heat and water limitations have led to early concerns about 2021 crop kernel sizes trending small. Harvest is just beginning to kick into high gear on Nonpareil and Independence, making it too early to draw definitive conclusions from early results.

|

Market Perspective As projected in July, a 3.5 billion lbs supply was reduced to ~600 million lbs of ending inventory. With annual shipments of ~2.9 billion, the 600 million lbs nets out to a moderate 75-day supply. With supply and demand rebalancing within the 2020 crop year, 2021 crop pricing is returning to levels that prevailed from 2017 through most of 2019. With the 600 million lbs ending inventory and a 2.8 billion lbs Objective Estimate, the 2021 total supply will be at or near the 3.5 billion lbs supply of last year. Nonpareil, Inshell and NPX kernels are seeing the biggest price lift in recognition of the robust global demand that emerged over the last twelve months. Nonpareil CPO sizing is a significant concern, based on last year’s experience further amplified by the even lower kernel weights in the NASS Estimate. Over the next 90 days, the outlook for 2021 crop will become progressively clearer. |

For Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here