Laura Gerhard

Vice President

OVERVIEW

October witnessed strong shipments, gaining momentum compared to the pace set in the previous year. Total shipments for the month reached 247 million pounds, marking a 12% increase from the previous month and a 15% increase from the same period last year. Exports accounted for 190.3 million pounds, demonstrating a 28% rise compared to the previous year. However, domestic shipments, totaling 57 million pounds, experienced a 13% decrease compared to the corresponding period last year. The year-to-date shipments for the first quarter of the crop year are now running 7.3% ahead of the previous year.

SHIPMENTS

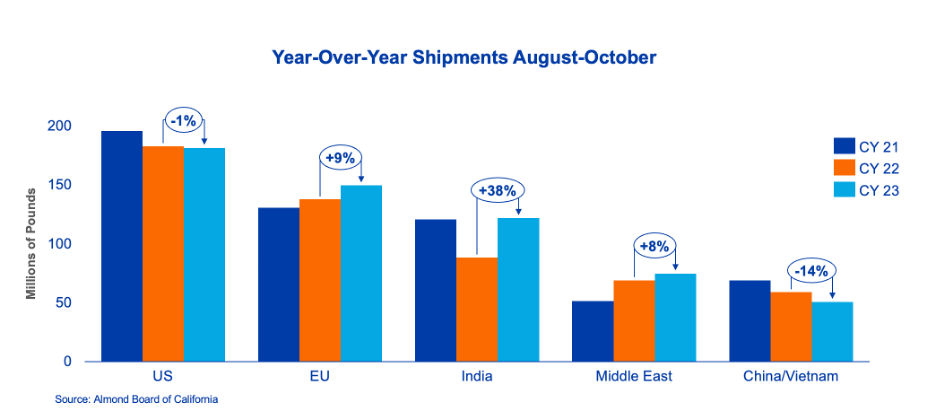

India: Shipments for the month were 48 million pounds, up 48% to last year. Year-to-date shipments are up 38%. Demand picked up in recent weeks now that buyers have had the opportunity to review their initial shipments of inshell and see the quality resulting from this year’s harvest. Shipments are expected to remain favorable going forward as India heads into the Diwali and wedding seasons.

China/Hong Kong/Vietnam: Shipments for the month of October were 29 million pounds, up 8% to last year. Year-to-date shipments to the region are down 14% to start the year. Market activity remains slow and steady to China. Buyers remain conservative in their purchasing of Nonpareil inshell almonds given demand uncertainty. Concern over insect damage associated with this year’s crop is also giving buyers pause and perhaps confirming their decision to proceed with caution. Vietnam had a strong month of shipments and is up 71% year to date as buyers take advantage of the pricing resulting from more favorable duties compared to US imports. Buyers will continue to monitor demand through the Chinese New Year holiday to determine what level they will need to replenish inventories.

Europe: October shipments to the market were up 17% to last year and up 6% to last month. Year-to-date shipments to Europe are up 9%. October is generally a strong shipment month to Europe. This market should continue to see good demand heading into the holiday season as it is largely uncovered heading into the new year. Macroeconomic issues remain the top concern for the region as it continues to work towards normalized demand.

Middle East: October shipments to the Middle East were up 72% to last year which puts this market up 8% for the season. This market continues to perform well as it positions itself for the upcoming Ramadan holiday though there is some demand risk as premiums for smaller kernel sizes have firmed on limited supply.

Domestic: October shipments came in at 57 million pounds and were lighter compared to prior year by 8 million pounds, down 13%. Year-to-date shipments are currently holding steady, with a minimal variance compared to last year, standing at 181 million pounds. Domestic commitments, however, are trailing behind last year by 17%, coming in at 271 million pounds. Despite this, there is a moderate improvement in pace compared to the previous month, which showed a decline of 23%. In the upcoming months, North America will be closely watched for insights into demand, as it plays a pivotal role in the industry’s efforts to reduce carryout.

COMMITMENTS

Total commitments are 677 million pounds, slightly behind last year by 2.5%. New sales for the month came in at 251 million pounds, up 7 million pounds, 3% compared to last year. Total new sales are 777 million pounds up 14.3% to last year. Assuming a 2.45 billion pound crop, shipments and sales currently represent 43% of the total supply.

CROP

Crop receipts for the year total 1.334 billion pounds. Adverse October weather challenged California’s almond harvest, halting it temporarily with heavy rainfall. The risk of crop loss and quality persisted amidst shorter days, morning dew, and sporadic rain. Drying complications persisted with reduced daylength, dropping temperatures, and higher humidity. Insect damage is prevalent this season and will be another limitation to sellable supply with some forecasting it as high as 4% of the crop. Many in the industry are now forecasting a crop closer to 2.45 billion pounds. The 2023 harvest is concluding as growers are bringing the crop in from the last few orchards.

|

Market Perspective The October position report was within industry expectations and fuels a much-needed strong start for this crop year. Strength from export markets continue to drive shipments while domestic shipments are slightly off last year’s pace. Prices firmed over the course of the month as California handlers remain conservative with offers while they work to understand their supply and quality of that supply. Buyers are largely focused on procuring the middle and smaller size kernels which are in short supply this crop year. This has caused prices to firm across the whole complex. The industry needs to keep building on the positive momentum with strong shipments and new sales for the first quarter of the crop year to continue to draw down the carryout. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here