Laura Gerhard

Vice President

OVERVIEW

Shipments for the month of September were within industry expectations at 217.7 million pounds, 2.7% higher to last month and 15.5% higher to last year. Exports were 154.8 million pounds, up 13.3% to last year. Domestic shipments were 62.8 million pounds, up 21.5% to last year. Year-to-date shipments after two months are 3.1% ahead of last year’s pace, a positive and welcome start to the season.

SHIPMENTS

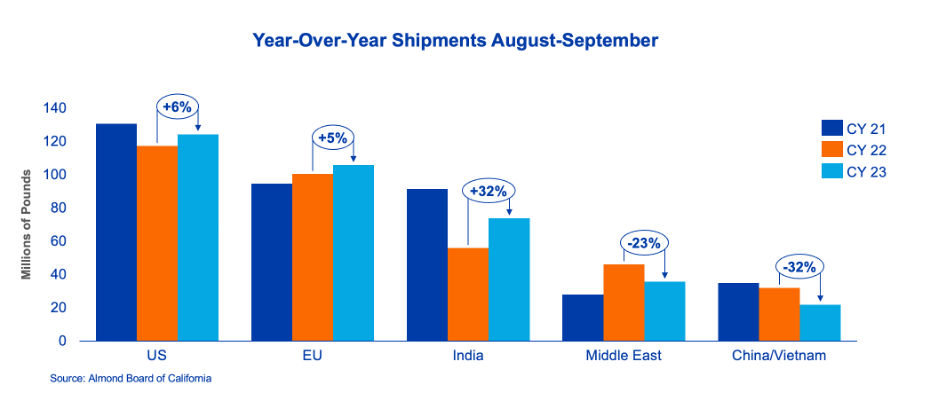

India: Shipments for the month were 51.3 million pounds, up 52% to last year. With a later harvest and strong early season demand, total shipments are now up 32% for the year. Demand has slowed in recent weeks with new crop supplies beginning to arrive at destination. Inshell quality concerns this season have prompted buyers to review their initial shipments before stepping back into the market. Nevertheless, the market is off to a strong start in the 2023 crop season.

China/Hong Kong/Vietnam: Shipments for the month of September were 13.2 million pounds, down 34% to last year. Year-to-date shipments to the region are down 32% to start the year. Activity has been subdued in recent weeks with buyers taking off to celebrate the Mid-Autumn festival. Demand reviews were mixed coming off the holiday with many still trying to gauge demand heading into the Chinese New Year holiday. Competing tree nuts occupied buyer attention to start October with pistachios and macadamias being the focus of purchase activity. Demand is expected to pick up in the coming weeks with product needing to move between now and early December to ensure on-time arrival for Chinese New Year.

Europe: September shipments were up 10% to last year and down 57% to last month. Year-to-date shipments are up 5% with Europe showing signs of demand normalizing. The October position report will be of top interest as it is generally a strong shipment month to Europe. Macroeconomic issues remain the top concern in the region and could further challenge future demand.

Middle East: September shipments to the Middle East were down 12.5% to last year. The market continues to work through heavy inventories that were held over the summer months. Quality concerns limited offers of nonpareil kernels into new crop and slowed activity in the short term. Middle East demand will begin to pick up as the market looks to cover Ramadan demand in coming weeks.

Domestic: September domestic shipments came in at 62.8 million pounds, an increase of 11.1 million pounds or 21.5% to last year. This is a positive step forward bringing year-to-date shipments to 124.2 million pounds, a 6% increase over last season. Domestic commitments lag the prior year by over 78 million pounds or down 23%, with many sales focused on shorter time horizons due to uncertainty around new crop and demand still stabilizing. Inflation impacts on food pricing continue to dampen consumer buying within the retail segment. However, after months of reducing inventory and production, retailers and manufacturers are beginning to prepare for various Holidays providing an opportunity for increased shipments in future months.

COMMITMENTS

Total commitments are 674 million pounds and remain ahead of last year by 1.2%. Uncommitted inventory is 309 million pounds, which is down 56.6% to last year. This is indicative of the fact that the harvest continues to lag last year’s pace. New sales for the month came in at 269.9 million pounds with exports making up 73% of that number. This is 12.4% higher compared to last season.

CROP

Crop receipts for the year total 625.4 million pounds. Harvest remains approximately 15 days behind last year’s pace. The industry pushed to get the crop in with sporadic showers throughout the month of September challenging harvest activities and continues to closely monitor crop yield and quality. Both insect damage and moisture are a threat to reduce salable supply. There is a growing urgency to bring the crop in as quickly as possible. The more prolonged harvest becomes, the greater the risk to quality as the days grow shorter bringing cooler temperatures and increased humidity.

|

Market Perspective The September position report fell within industry expectations as shipments remain ahead of last year’s pace. Markets are steady with buyers mainly staying mostly hand-to-mouth. Activity waned into the final week of the month with many Asian markets on holiday. Price discovery continues to be challenging with sellers pausing to better understand crop quality and buyers waiting for price stabilization. Demand is expected to pick up in the coming weeks with buyers needing to get product moving to ensure on-time arrival for the upcoming holiday seasons. The late harvest continues to present challenges as the industry pushes to get the remainder of the crop in to avoid any further quality issues. More time is needed to understand the overall production and quality potential of this crop. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here