Bill Morecraft

Senior Vice President

Blue Diamond Growers

November 12, 2015

Overview –

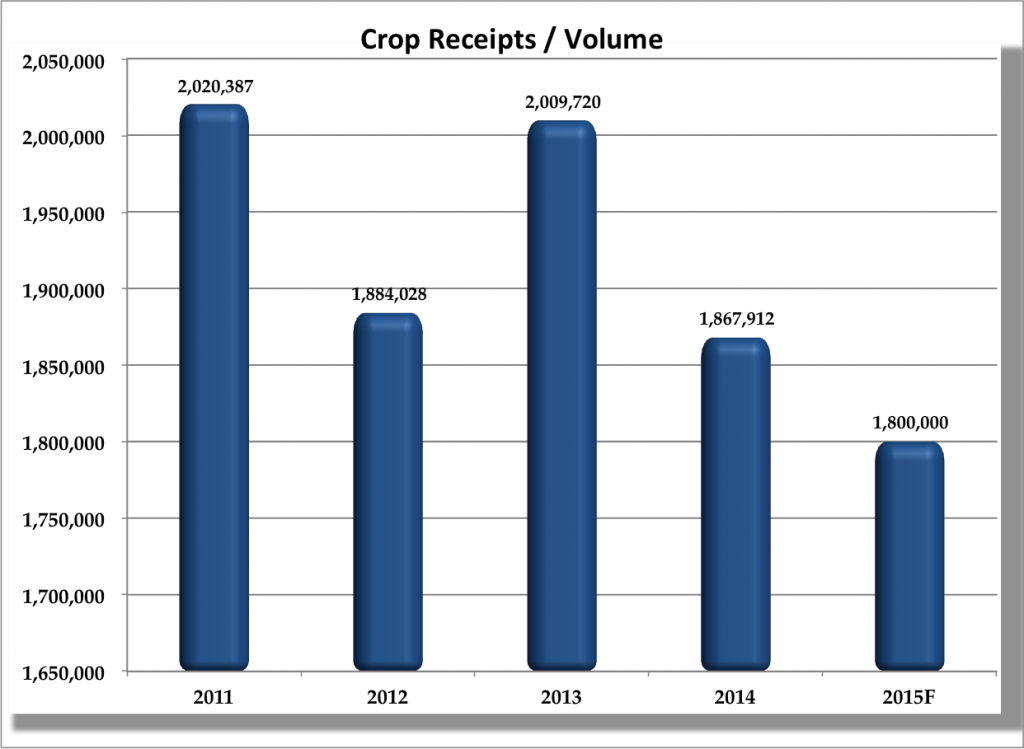

The October Almond Board Position report was released yesterday, providing data that brings further context to the activity of the last twelve weeks since harvest began. Receipts for the 2015 crop remain smaller than the 2014 crop receipts at the end of last October, with the shortfall widening since September. The final 2015 crop will be close to the NASS 1.8 billion lb Objective Estimate.

As expected, shipments in October were significantly below the prior year. Worldwide shipments trail last year by 15% year-to-date, with a modest decline in the U.S. market and larger declines outside the U.S. The reduced shipments in many export markets reflect buyers reducing exposure to higher priced inventories in response to declining California prices since August. The high initial prices, and the early price corrections, created a more cautious buying and shipping trend that served to reinforce the desire to limit buyers’ inventories.

However, very little of the reduced shipments reflect underlying decline in consumer demand. Due to the reduction in inventories, forward demand in many export markets will reappear as quickly as prices stabilize. Prices over the last few weeks have already dropped below the levels at which the larger 2014 crop was sold.

In India, the Diwali season was disappointing for profits, but sales volume was strong. Inventories are depleted as the market enters the wedding season. In Dubai, high priced contracts were defaulted as undercapitalized buyers flee the market. Inventory is being steadily resold in other export markets, leaving the market open for significant spring and Ramadan demand. Almond inventories in China are also low as Chinese New Year and spring demand approach. November shipment activity is already promising.

| Market Perspective –

The second half of the 2015 almond crop should see more stable and moderate pricing from California than in the last few months. Demand for California almonds remains strong as consumers globally continue making almonds a part of a healthy lifestyle. With prices already lower than at the same time last year, sales and shipment volumes will increase in the winter months. Buyers with short inventories will return quickly when they see stable pricing. The best buying opportunities of the year are likely to occur in the upcoming weeks.

Click here to view the entire detailed Position Report from the Almond Board of California site: |