Laura Gerhard

Vice President

OVERVIEW

The final position report of the 2021 crop year fell short of expectations resulting in the lowest shipment figure of the year. Shipments for the month totaled 169 million pounds, down 26% from last year’s record month. Complications in container shipments weighed heavily on the low number with the port of Oakland shut down for the better part of one week due to a trucker strike. As a result, export shipments were down 29% from last year, causing this period to be a crop year low at 112 million pounds. Domestic shipments, which have mostly been consistent all year, came in at 57 million pounds which is a 19% decrease versus last year. In total, shipments ended the year at 2.63 billion pounds, down 9% versus last year.

SHIPMENTS

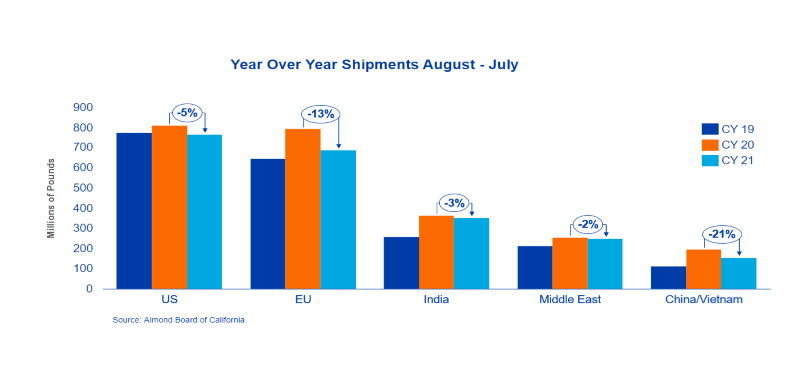

India: Despite the considerable headwinds with COVID, economic factors and huge logistical issues, India shipments came in at an impressive 352.6 million pounds year-to-date. While down 3% from last year’s tremendous record, the strong demand potential in this market has positioned India as a year-round market, even though many regions of the country are still underdeveloped for almond consumption. Purchasing for Diwali 2022 is already complete, and the market will be hungry for replenishment.

China: China ended the year at 127.3 million pounds, down 22% to last year, with logistical challenges and COVID restrictions impeding demand. New crop in-shell sales have picked up with buyers needing to secure supplies for arrival in time for the Chinese New Year holiday which falls earlier this year in January. Buyers remain cautious given demand uncertainty from macro-economic and COVID challenges facing this market. The upcoming Mid-Autumn Festival in September will provide an opportunity to gauge the strength of consumer demand.

Europe: July shipments to the European market slowed as heavy supply has shipped into the market over the last 4 months. Compared to last July, this season was uncharacteristically slow in new sales activity as the market carries a longer position into new crops. Headwinds continue with inflationary pressure, a 15% weaker currency than the same time last year and additional concerns around energy scarcity as markets move into the heavier energy consuming winter months. While August typically represents a slowdown in sales activity within the region, lighter shipments will continue into the first quarter as markets are well covered.

Middle East: The Middle East market ended the 2021 crop season down 2% compared to the prior season. Over the last 6 months, the Middle East shipped more than the previous year’s corresponding period, which has left many in a long position. Similar to the European market, the beginning of the 2022 crop season will likely be slower as the market moves through its early position.

Domestic: The final month of the 2021 crop season posted shipments of 57.1 million pounds, down 19% over the prior year’s record. This brings the region’s total shipment number for the season to 764.6 million pounds, down 5.6%. The overall decline in shipments this year is slightly larger than the 4% gains seen during the 2020 crop season and further illustrates the return to pre-COVID lockdown consumption patterns in the United States.

COMMITMENTS

Total committed shipments for the crop year equal 348 million pounds, up 1% from last July. New sales for the current crop were down 19%. Uncommitted inventory ended the year at 490 million pounds, 93.8% higher than last year at this time. Sold and shipped as a percent of total supply is at 86% versus 93% last year. The industry hoped to carry the momentum of previous months into July, but shipments fell short due to the trucker strike at the port of Oakland in opposition to California’s AB 5 legislation. This resulted in the loss of nearly one week of shipments and eliminated any chance of breaking below an 800-million-pound carryout.

New crop sales continue to be sluggish with commitments for the month reported at 62 million pounds compared to 155 million pounds last year. The year-to-date commitment total for the 2022 crop year is 298 million pounds, down 32% compared to last year.

CROP

The 2021 California almond crop is complete and in the books at 2.92 billion pounds. With the 2022 crop harvest underway, the industry will start to get a feel for crop quality in the coming weeks.

|

Market Perspective After four strong months, with May and June setting new records, the 2022 crop season closed with shipments falling short of expectations. Domestic shipments took a step back while export shipments struggled to execute turning in the lowest performance of the year. Any attempt to firm price following the Objective Estimate was short-lived given ample supply and large uncommitted inventories. Market activity was light for the month as the industry transitioned over to the new crop. Price is trying to find its footing given demand uncertainty as buyers remain cautious considering macro-economic pressures. Container shipment execution will continue to be a priority as we approach the holiday season. Harvest is underway as packers begin to receive new crop almonds. The outlook for the 2022 crop will become clearer over the coming weeks as the industry evaluates quality and supply. |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here