Laura Gerhard

Vice President

OVERVIEW

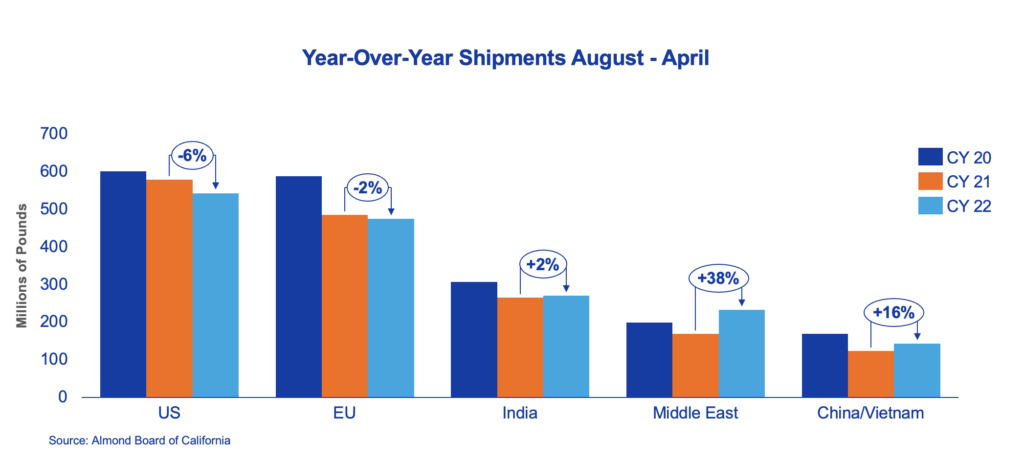

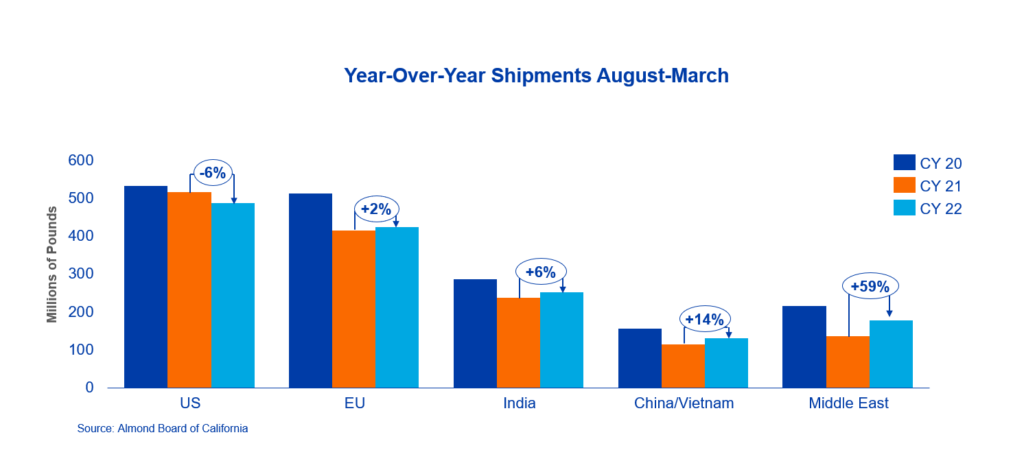

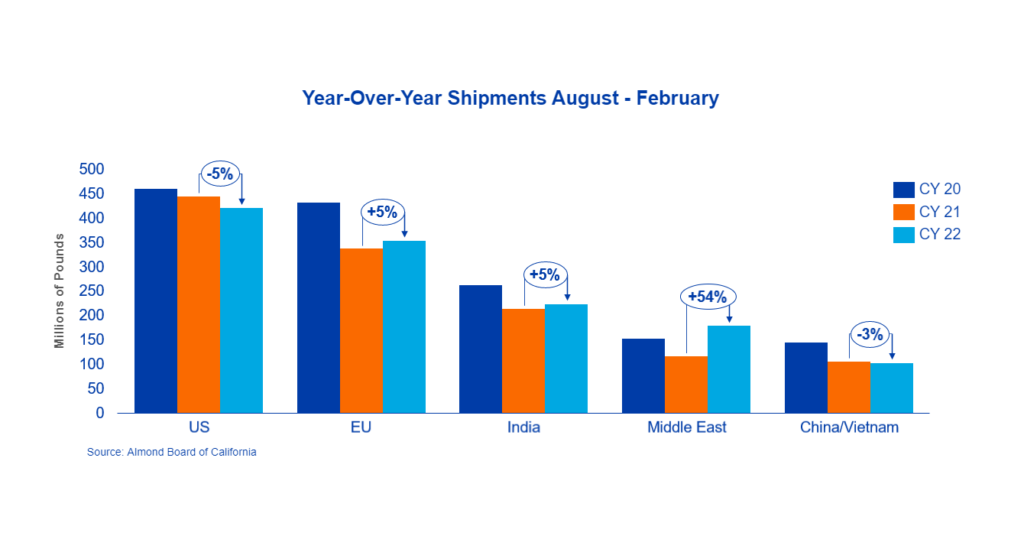

Following three record-setting months industry shipments softened in April, registering 197 million pounds. This is 20% lower than last year and falls short of industry expectations. Export shipments for the month were 140 million pounds, down 35% to last month (a crop year high) and 23% to the prior year. Exports have been resilient this year and are now 7.6% ahead of last season after nine months. This is a bright spot for the almond industry as it continues to drive the carryout down to more manageable levels. Domestic shipments continue to lag at 56.8 million pounds, down 9% to last year. Overall, total shipments remain in positive territory ahead of last year at 3.5% year-to-date.

SHIPMENTS

India: Shipments to India were 20 million pounds for the month, down 28.7% to last April. The market now sits 2% up for the year. Like many global markets, local inventories are healthy and are being purchased at lowers levels. With prices from California rising over the last six weeks, the market has seen local pricing follow. With a later Diwali next season we expect to see lighter shipments versus a year ago for the duration of the crop year.

China: Shipments to China were 10 million pounds, 47% higher to last April. Year-to-date shipments are now 21% over last crop year, which is impressive considering this market was behind as much as 24% earlier in the crop year and it serves as a reminder of the demand potential going forward. Local inventories are healthy and are being purchased at lower prices compared to today’s market which has limited buying activity from California and Australia in recent weeks. Offers have firmed on news of a shorter crop and quality falling short of Chinese expectations.

Europe: Shipments to the European market were 50.9 million pounds for the month, down 28% versus last April. The market now sits 2% down for the season. With offers from California rising nearly $0.50/lb over the last two months, this market has pulled back on additional coverage. With shipping challenges largely out of the way and higher origin pricing, it is unlikely that the market will repeat last year’s strong shipment levels and return to a more normal shipping pattern as we move in to the 2023 crop. Fall and 2023 holiday demand remains uncovered, and it is likely that Europe will need to purchase additional coverage in the next six to eight weeks.

Middle East: After outperforming the first eight months of the crop year the Middle East saw a slowdown in purchasing with April shipments from California recording 17.9 million pounds, down 47% to last year. Lower and affordable almond prices have fueled demand, putting year-to-date shipments 38% ahead of last year. In this market (unlike Europe and US) the weaker price hits the store shelf quicker, directly benefiting the consumer. This is a positive sign for future demand.

Domestic: Key channels and categories driving almond consumption continue to face headwinds with inflationary pressures affecting consumer spending habits. Retailers are also taking the opportunity with the higher costs to reduce stocks back to pre-pandemic levels compared to the high levels of finished good stocks on-hand during COVID. As a result, the domestic market continues to struggle with shipments down 9% for the month and 6% year-to-date. Expectations are for current demand patterns to persist for the balance of the crop year.

COMMITMENTS

Commitments are at 565 million pounds, down 25% to last year. Uncommitted inventory sits at 789 million pounds, 2% higher compared to last year. Market activity was limited in April as evidenced by new sales at 115 million pounds, down 32% to last year and the lowest figure for the month since 2017. Uncertainty surrounding the 2023 California almond crop has firmed offers as packers take a cautious approach. Demand is thin at the moment with buyers mostly covered in the short term.

Shipments are expected to wane in the final three months of the crop year. Current predictions for the carryout are above 700 million pounds with some predicting lower and others slightly higher. This is a big improvement over last year’s record carryout and puts the industry in a more manageable position heading into the next crop year.

CROP

The 2023 Subjective Estimate was released on May 12 with the NASS forecasting a 2.5 billion pound crop against 1.38 million bearing acres. This implies a yield of 1,810 pounds per acre, the lowest since 2005. Many note that the crop is at least two weeks behind last year’s pace, potentially setting the industry up for a later harvest.

Assuming crop production on the high end of estimates at 2.5 billion pounds, the industry should achieve the desired result of further driving down the carryout to more comfortable levels to end the next crop year. At a minimum this lends to price stabilizing at the new levels we are seeing today.

|

Market Perspective Shipments eased off their recent record-breaking pace but remain ahead of last year’s pace. Prices have firmed on concerns of a smaller 2023 crop. This has limited activity for buyers and sellers alike as the market processes all the new information and forecasts from recent weeks. While lower shipments are expected in the final three months of the crop year the industry is in a good position to improve the carryout to a more comfortable level. Given the lack of new sales in recent months, it’s clear that many markets remain uncovered into new crop. Price discovery will be difficult in the short term as market participants continue to wait for more guidance on the upcoming crop. Current concerns should limit downside price risk until more information is available. There’s a lot of time left before harvest and the industry’s focus will mainly be on crop development. The Blue Diamond team will be attending INC London. We hope to see you there! |

To view Blue Diamond’s Market Updates and Bloom Reports Online Click Here

To view the entire detailed Position Report from the Almond Board of California Click Here